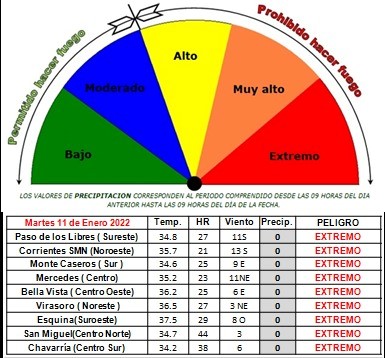

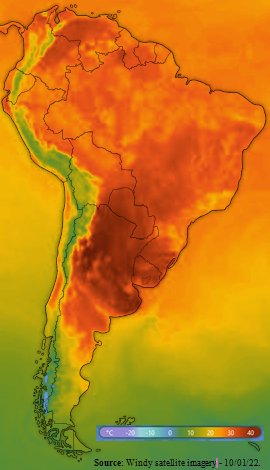

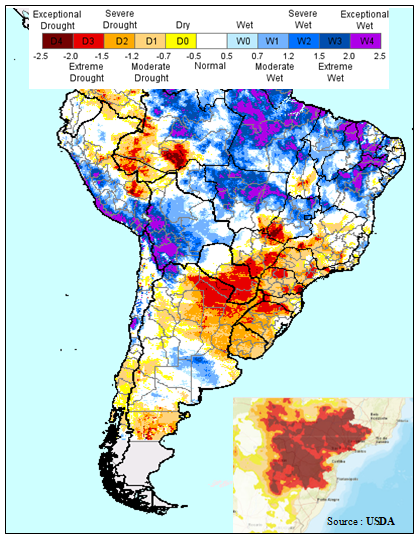

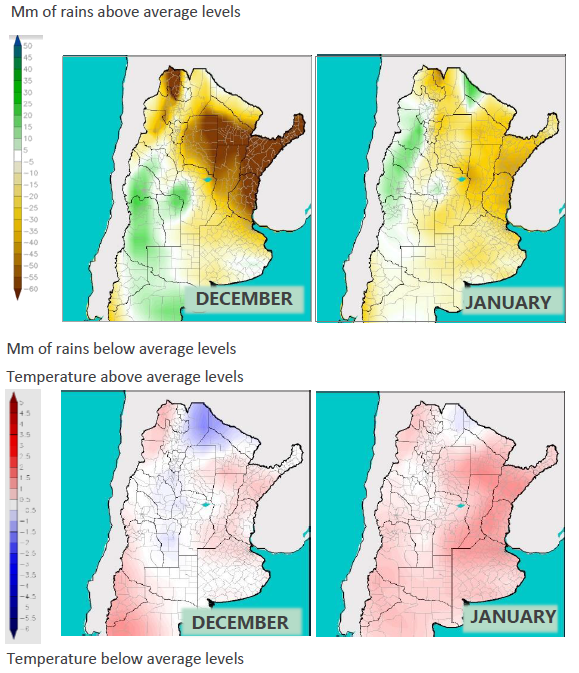

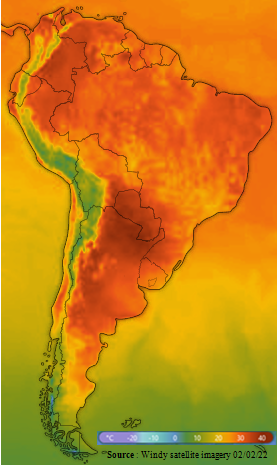

Weather: The Situation remains unchanged as our region is still facing “extreme drought” conditions. No rain occurred since a while and we are registering high-temperature peaks.

Rice: On 25/01/22, we began to harvest our 1st block. So far, we have harvested 26 ha and got a preliminary yield of 5.7 t/ha with an index quality of 58 entire grain. Given our past year experience with similar conditions, we got a better yield and a much better quality in those plots than last harvest.

Water stress recorded over the past months affected the grain development in its blooming stage (unfilled grains) in some plots. We tried to manage water needs the best way we could and provide as much as possible water to each plots according to its irrigation stage with our artificial lake as the river was dry but our reserve could not always cover all optimal needs for the entire sowed area.

You can see below the difference of an optimal field we have and another affected by water stress. Meanwhile, we continue with the harvest of our other blocks as humidity of grains is going down very quickly given the heat weave faced, and we are expecting various yield deviation from the plan so as quality depending the plots/blocks.

Soybean: 250 ha of soy have been damaged by the extremely hot and dry weather. As you can see lots of flowers and grains in this area could not finish their normal development. Lost in yields have to be anticipated and we estimated an average yield of 1t/ha for this area versus 2.5t/ha projected.

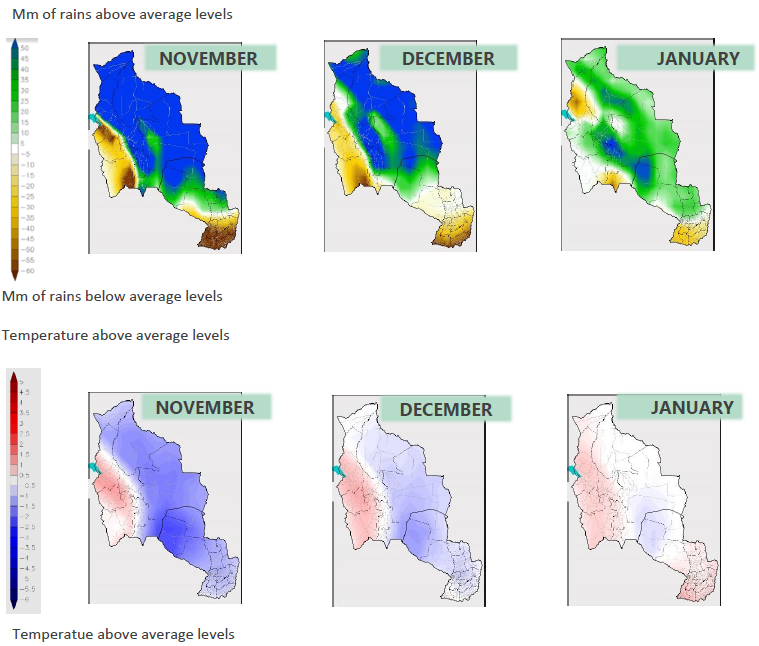

Our situation is not unique as Paraguay’s Agriculture Ministry has just announced a 40% drop in soybean harvest this season for the country due to the unprecedented weather conditions. In some Paraguayan towns, some producers have already reported losses of 70% to 100% in some batches.

In addition to the agricultural performance, other considerations need to address the logistics situation. Most exports are shipped through the Paraná River, which suffered for the past 2 years from the worst downspout in the last 77 years.

The Paraná river is part of a significant trade circuit for several South American countries— namely Argentina, Paraguay, Brazil, Uruguay, and Bolivia. Many grain-bearing trade ships have had no other choice than to lower their carrying capacities to prevent interference from the increasingly shallow riverbed. This has raised significantly transportation prices and delivery delays.