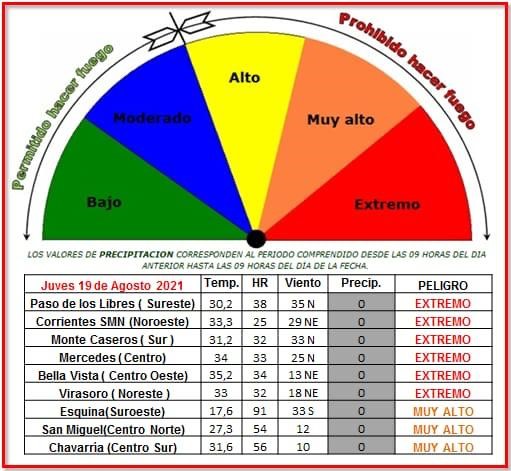

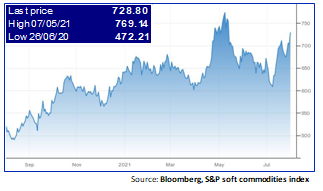

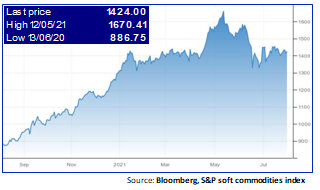

Weather/Situation: Despite the recent rains recorded, the level of the Paraguay River remains at an extremely low level continuing to greatly disrupt traffic on the river. According to the Paraguayan meteorological and hydrological authorities, the situation is far from being reversed in the short term and the river still continues to drop by an average of 2 to 3 cm per day, despite the recent rainfall. This situation disrupts not only the supplies of the agricultural operators (see previous posts) but also their operations. On top, disruption in supply and increasing prices of oil do not help either.

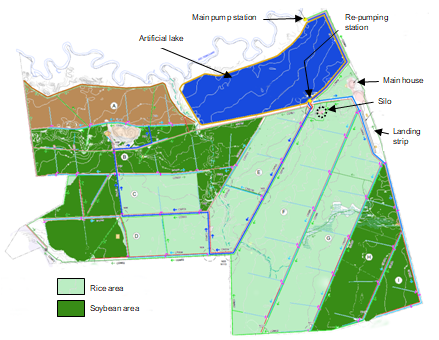

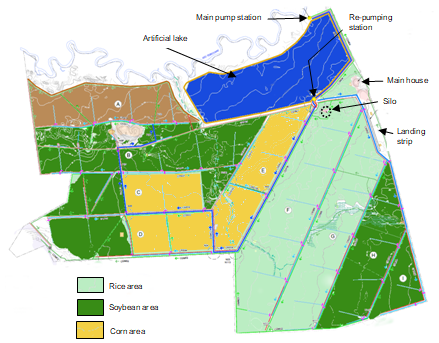

In our case, we are currently luckier as the recent rains enable to raise the level of the river enough to restart pumping directly to the fields as you can see. Our artificial lake which serves as water reserve in dry period is also fulfilled to its limit. We registered the heaviest rains in the country.

Rice: 160 ha of rice have been yet sowed. Due to rains, we had to stop but we are now restarting sowing in block F. You can see below the crop emerging on the surface already sowed. Last week of October, we will start to irrigate the block during 90 days.

In block G (450 ha) , we are going to apply herbicide to control weeds Subject to weather forecasts and water availability in the river for direct pumping, we will see in November with our partner GPSA if we are going to sow rice in this area. Under this scenario, we are going to sow 1,000 ha of rice this year. Otherwise, the herbicide applied will help to maintain the land clean and we will 560 ha of rice cultivation this year.

Soybean: We have started to sow soybean in block D and we currently maintain our forecasts to plant 1,100 ha with this crops.

You can see below some drainage channels build for the crop. Soybeans need good drainage for increased yield.

Corn: Rather than increasing the potential soybean area by reallocating rice surface in block E, D and F to soybean, we are analysis the opportunity with our partner to sow there corn in December given to good outlook for this crops and to diversify our risk/mix. We have under review the possibility to allocate 560 ha to this cultivation.

The climate requires us to be pragmatic with some kind of flexibility. Subject to weather conditions, we would be able this year to sow above 2,500 ha with 3 various crops (rice, soybean and corn).