PARAGUAY – Advances in land preparation at Salitre Cue farm (July 2020).

After having registered 10 days of dense rains, we restarted with land preparation activities. After a drought period, a small rain can helps land based work but not 10 days of continues dense rains. However, with machinery operating at full power, we will very quickly catch-up and we have already prepared over 600 ha so far. The good news, is that those rains helps the fully naturally our reservoir as we need full water capacity for the coming irrigation period of the cycle.

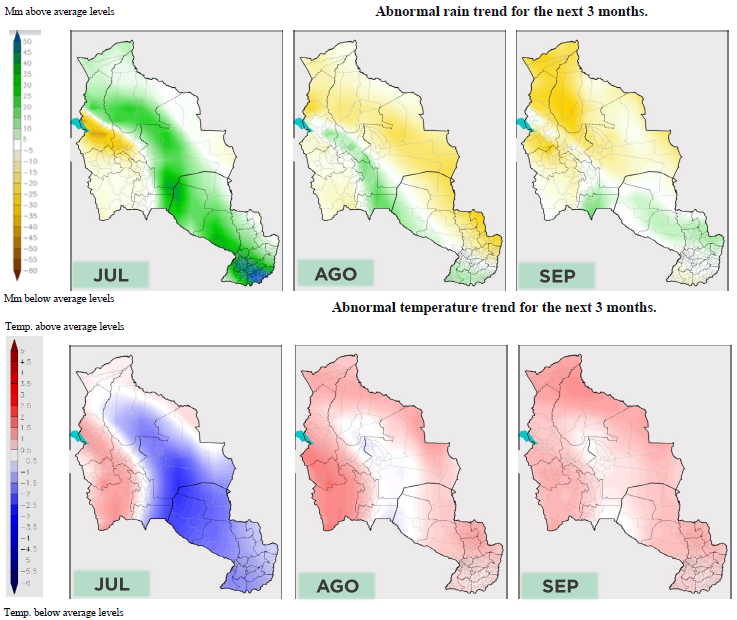

According to the latest weather forecasts, we should register heavier rains than it use to be for the season and that until mid august. Then, the situation should progressively reverse from September onwards (below normal, especially in the spring). Temperatures are going to follow the same trend (below average until mid August, than the averages). Experts are predicting La Niña phenomenon for this season on our region. Therefore, current rains help reducing pumping costs to fully the reservoir but will also be useful during irrigation period of the fields, and engines have to work full capacity during the days it doesn’t rain to be ready for sowing stage.

We are taking advantage of the good weather to aerial spray the fields with herbicide to control the weeds as you can see. All those work will make root penetration easier, and facilitate irrigation and drainage. It improves weeds and crop residues distribution the field so as their control, and incorporate them into the soil.

ARGENTINA – New extension on debt talks and peak virus period (July 2020).

President Fernandez has announced a further extension of debt negotiations deadline until August 4. It’s now the fifth extension but Argentina needs to reach an acceptable compromise to restructure more than $65 billion of debt. The country is already in technical default since May 22 after failing to make its $500 million interest payments due. According to local news, it seems that 2 groups of creditors are whiling to accept the latest offer made.

Meanwhile, the country seems to reach the peak of the pandemic: 75 deaths have been registered on the single day of July 6 and 2,632 new cases declared. More than 80,000 people have now been infected with Covid-19 in Argentina. Over 90% of all confirmed cases are in Buenos Aires metropolitan area where around 14 million people live. Restrictions have been enhanced again like access to Buenos Aires city, public transportation, etc.

Latest news: President of Brazil, Jair Bolsonaro, has been declared positive to covid-19 on July 7. Since the beginning of the pandemic, he minimizes illness and participates in several public events without wearing a mask. He was strongly criticizing isolation measures implemented in several states to reduce the risk of disease spread. He said that his history as an athlete would protect him from the virus, and that it would be nothing more than a “little flu” were he to contract it. He might change his position now.

PARAGUAY – Itaipu dam has opened its spillway to help lift the drought (July 2020).

Argentina, Brazil, and Paraguay have agreed on the opening of the spillway of Itaipu plant (it’s the world largest operational hydroelectric dam) to help Paraguay and Argentina, which are suffering from a drought and having problems to transport their grain harvest on the Paraguay River.

PARAGUAY – Land preparation has started at Salitre Cue farm (June 2020).

We have begging on June 22 with initial land preparation work of the fields. This cycle, we planned to sow 1,530 ha with rice in association with a local landing seeds and agrochemical family group. We hope that you will have at least the same level of production results. For the past cycle, we have got 8t/ha as yield with an average index quality of 55. We produced over 12,000 tons of paddy rice and our silos are now empty.

In terms of sales, we notice that rice prices have well increased in May due to exports to Africa and Pakistan. The situation was driven by food securitization fear of those countries due to Covid-19 pandemic. On the opposite, Brazil almost disappears this cycle in terms of rice import from Paraguay (generally 90% of Paraguayan rice production is exported to Brazil) but they are also not exporting they own production. Covid-19 pandemic has created fear and panic on food supply chains.

We continue to follow sanitary recommendations and strict protocols to ensure our employees and contractors’ the saves work environment possible.

For now, our attention is focused on land preparation which is important to ensure that the rice field is ready for planting. It is also creating a favourable environment for the rice plants to germinate and grow.

A well-prepared field improve soil structure (better ventilation, permeability, and loosening of the root zone) to make root penetration easier, and facilitate irrigation and drainage. It improves weeds and crop residues distribution the field so as their control, and incorporate them into the soil.

All our contractors are at farm and are starting their activities after filling their machines with gas.

ARGENTINA – Debt talks hit a wall, and Agriculture sector is lobbying (June 2020).

Talks to restructure more than $65 billion in foreign debt seemed to have hit a wall as one of the main groups of bondholders is now evaluating his option to seek repayment in the courts. Officials and creditors failed to find common ground after 2 bondholder groups submitted an offer before the latest deadline. Argentina has set a deadline of June 19 on its latest proposal after extending it 4 times, but the deadline doesn’t have tangible impact since the country fell into default on May 22 after missing overdue interest payments of $500 million (please refer to previous posts).

As tensions mount, the government is considering all possible options, among them asking the International Monetary Fund for a new programme sooner than previously planned or using payments tied to agriculture exports. Farmers are lobbying against Economy Minister’s Martín Guzmán proposal as “A measure like this would mean export taxes couldn’t be scrapped until the bond matures”.

The farm industry is key for tax revenues and to bring in dollars: Argentina’s crop exports were valued at $23.7 billion last year.

President Fernández hiked export taxes already 6 months ago when he took office. More recently, the central bank has taken steps to prompt farmers to sell their soy harvests. Dual foreign-exchange rates are also driving concerns about input prices which are becoming very expensive, and we previously talked about Vicentin expropriation. Ultimately, authorities are trying to manage farm products exports and to get their dollars. What comes next…and for now, the new deadline has been set for July 24.