ARGENTINA – Update on San Bartolo farm activities (June 2020).

Situation/weather: The farm is slowly recovering after the torrential rains registered earlier in February. The water is very slow to evacuate as the problem was emphasised by the illegal internal protection walls build by some farmers upper the river which affected and changed water course. By end of June, we will start with the support of local authorities to clean and drain the river El Dorado as well as to build some protective dyke around the perimeter, approved by the water regulation authority.

Cattle operation (2,900 heads): The gauchos have transferred the cattle of flooded sections to dry area close to the corral in order to prevent sanitary issues (hoof disease, tick) and cattle losses (weight loss, injury, etc). Transfer of Cattle video

Particular attention was paid to the move of baby calves to avoid losses are they are the most sensitive category given their morphology. Soon, we will also perform with the assistance of our vet team, pregnancy test of cows which were earlier in service.

We are also in the process of delivering 240 calves that we sold as opportunities arise for the strong domestic market and export. After America’s meat-processing woes opened up a window for importers, Argentina shipped 1,290 metric tons to the United States in April. A year ago, US importers bought only 2 tons. April is the same month that outbreaks of Covid-19 among US meatpacking workers triggered a wave of shutdowns that tightened local supply and sent prices rocketing. Argentine beef exports had already begun to pick up under President Mauricio Macri, who left office in December. Macri negotiated access to the US market, which re-opened to Argentina in late 2018, ending a ban that began in 2001 after an outbreak of foot-and-mouth disease.

Even under President Alberto Fernández, who prefers intervention over Macri’s free-market approach, Argentine beef export boom seems set to continue. Uruguay also benefited from shortages in the US.

ARGENTINA – Nationalization of agro-export giant Vicentin (June 2020).

President Alberto Fernández announced on June 8 in the evening that the government will intervene and expropriate bankrupt agricultural giant Vicentin. The President said the move to save the bankrupt agro-export giant was predominantly motivated by a wish to save jobs: “We are going to come to the rescue of Vicentín and defend its 2,600 workers,” and added “Around 2,600 local producers can still count on a company that will be able to trade their production.”

The government will take control of Vicentin for the next 60 days as it seeks congressional approval to expropriate the agricultural powerhouse, which filed for bankruptcy last year after being caught out in currency swings. Vicentin’s fate has been closely tied to politics. The company expanded under the presidency of market-friendly Mauricio Macri and then fell into disarray when Fernandez emerged as his likely replacement.

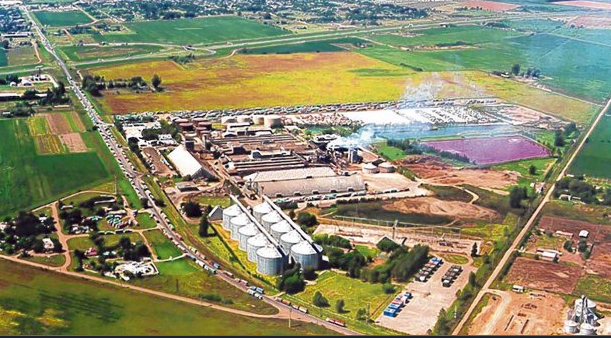

Vicentin is a family company with 90 years in the business, which started facing severe financial issues in 2019.The company defaulted on about $1.5 billion of debt last year. A court in Santa Fe province, where the company is headquartered, has been overseeing a bankruptcy in a procedure that’s similar to Chapter 11 in the U.S. A big part of Vicentin’s debt is owed to state-run Banco Nacion. But the expropriation plan was still a surprise to company executives, who’ve been in talks with existing partner Glencore Plc and other companies, a spokesman said. Switzerland-based Glencore has a joint venture with Vicentin called Renova, which includes one of the world’s biggest soy-crushing plants with 20,000 mt of daily crushing capacity. However, Fernandez said it was too soon to say how a new state partnership with Glencore would work.Gabriel Delgado, who was an agriculture secretary under Kirchner, will lead the government’s intervention of Vicentin. Assets will be placed in a trust to be managed by the agriculture department of state-run YPF SA.

This surprised announcement raises again another question: Who exactly is governing Argentina? Fernandez, who’s far from a free-marketeer but viewed as a moderate, or his deputy, Kirchner, a figurehead for fervent supporters of Latin American leftism and nationalism.

The move comes at a delicate time for Argentina, which is negotiating a restructuring of $65 billion in overseas debt. It also revives memories of the 2012 nationalization of YPF and other companies during the presidency of Kirchner, and raises questions about how Argentina will lure private-sector investments to lift its economy off the floor.It s also worth to remind that Mrs Kirchner never forgot the Argentine farmers strike in 2008 over levies on exports which almost forced her to resign, and also recalls that many farmers (those who could) would prefer to hold on to their crops, until they could have access to a more transparent foreign exchange market for the US dollar. To be followed …

ARGENTINA – Another extension of debt negotiations deadline (June 2020).

For the 3rd time, the government has extended its deadline to restructure more than $65 billion in a bid to seal a deal with its creditors. The news was confirmed by the Economy Ministry Martín Guzmán on June 1st, which hinted Argentina will sweeten its offer to creditors one more time in a bid to seal a deal before the new shut-off point of June 12. The government said it would announce results by June 15 or “as soon as possible thereafter.”

In parallel, lockdown in Buenos Aires and its surroundings could last until late July/early of August as virus peak is near, according to City government official.

ARGENTINA – New extension of debt negotiations deadline (May 2020).

While the Government has extended quarantine for 15 more days until June 7 amid rise in infections, Argentina fell into its ninth default on May 22 after failing to make its $500 million interest payments due.

Government and creditors continue negotiating, as Economy Ministry Martín Guzmán extends deadline for talks until June 2 to reach a deal. Argentina is looking to restructure $65 billion in international debt (please refer to previous posts of April and May 2020).

While bondholders now have the option to take Argentina to court to sue for full repayment, creditors said last week that legal action against the country would be counterproductive. Argentina’s bonds have risen in recent weeks to trade between 30 and 40 cents on the dollar, reflecting increased optimism that a deal will be reached. However, there is still a gap of about 20 cents on the dollar between what the government was offering and what creditors want.

The government remains flexible on the specifics of the deal as the country already faced its third year of recession and without a deal, Argentina would suffer even more of the full effect of default. The arrival of the coronavirus pandemic is just the cherry on the cake that Argentina needed. To be continued …

ARGENTINA – Update on Tata Cua forest activities (May 2020).

The lockdown has been extended until May 24, with adjustments depending on the region. The strictest limits are applied in the capital and the province of Buenos Aires, which concentrates most cases of COVID-19 (86%). Outside of this area, the country is gradually reopening (smaller cities like Corrientes could already return to almost normal activities).

That said, loggings of timber at Tata Cua forest are on schedule. End of March, we sold 615 m3 of wood to be cut (pines and eucalyptus) to a wood processor. So far, 50% of the planned cuts have been completed. Almost all pines area sold was cut down and delivered while eucalyptus cuts will restart. 2 additional months are expected to complete full wood-cuttings.