Paraguay- Update on Salitre Cue farm rice production (April 2018).

Harvest: We now completed the harvest of all plots, dried and stored our production in our silos. Over 9,200 tonnes of paddy rice have been produced during this campaign, and meaning a year-on year improvement in production results as as our average yield was above 7 t/ha (dry).

Sales: We have started to sell and deliver some of our production (limited quantity). However, local prices are depressed as most of Paraguayan rice production final market is Brazil, currently again affected by political tensions with the Lula’s case which translated in depreciation of the Brazilian Real against USD (reference currency for Paraguayan rice price).

Thanks to our silo facilities, we can continue to store our production and waiting for better market prices.

Argentina – Central Bank intervention to fend off inflation (March 2018).

Earlier this month, the Central Bank (BCRA) had to sold massively USD in the spot market to halt peso weakening after the USD quote fell to a record of ARS 20,65.

The BCRA is concerned about the impact that the weaker ARS can have on the already very high inflation. National inflation is now expected to be 15% at the end of the year while a range of 12% to 17% was targeted previously. Economists are more septic about and they expected an inflation of 20% minimum.

According to the National Statistics Institute (INDEC), national consumer prices rose 2.4% over the previous month in February, coming in above January’s 1.8% rise. However, the increase was expected due to a hike in prices of electricity, transportation, communication and medicine that came into effect on February 1, 2018.

Argentina – Update on Curupi Pora farm activities (March 2018)

Situation/weather: Drought has prevailed in northern Argentina during most of the growing season that began in late September and October. Dryness reached serious proportions a number of times, but most recently during January and February. Corrientes province, which is mainly focused on cattle and rice operations as well as forestry, was not spared from La Niña phenomenon.

As of 03/16/2018, cumulative rainfall for the cycle was 796 mm or -29% compared with the historical average for the same period. The good news is that we are now again able to access the limit of the farm bordering with Santa Lucia river.

Cattle operation: our cattle herd (5,911 heads currently) is overall in good conditions even if some categories, more sensitive to high temperature, are a bit lighter than they should be. An abundant supply in water to the herd is key here, completed by other actions (high quality silage, more health controls, cattle handling only early in the morning during heat waves, etc). Management is key during those phases.

Pasture-fed cattle: Pasture planted last October showed good resilience to heat waves and water shortfalls. We are also in the process to start aerial sowing of 144 hectares with OAT. OAT not only has a high protein content to feed cattle but is also cleaning the soil and improving its structure. This sowing will be completed with Ray grass pasture over 260 hectares as it supports high loads of animals per hectare, making it a species

particularly suitable for grazing.

Corn: 270 ha have been sowed in February for self-consumption after having been delayed due to lack of humidity. For now, the crop is in blooming stage but we already anticipate to get lower yield than usually (4.75 t/ha) given delay faced in sowing and dryness.

Argentina/Uruguay – Drought damaged over half of the Argentinean crop and extent to the region (February 2018)

Until mid-January, farmers in the Latin American countries endured a lack of rain and drought has continued to worsen, especially in Argentina and in the heart of the Pampa húmeda. Fields didn’t get enough rain to ensure an optimal soil moisture (less than 1/5 of the average rainfall was registered for January) while temperatures are higher than usually. The situation is not unique for Argentina; South of Brazil and Uruguay are experiencing similar weather conditions.

Furthermore, February is the month when corn and soybeans are in their fill stages (the reverse of August in the Northern Hemisphere) and the lack of soil moisture has begun to affect critical stages of both crops. According to the latest weekly report from the Buenos Aires Cereal Exchange, approximately 13 million hectares of grains production (soybeans, corn, sunflower, etc) are damaged in Argentina. The hydrical stress is affecting mostly the soybeans.

Hot, dry weather in the world’s #3 exporter of raw soybeans and top supplier of soy meal livestock feed has pushed up prices on the Chicago Board of Trade (CBOT) in recent weeks, with soybean futures hitting a seven-month peak on 02/22/18.

Article from Perfil, dated 21/02/2018

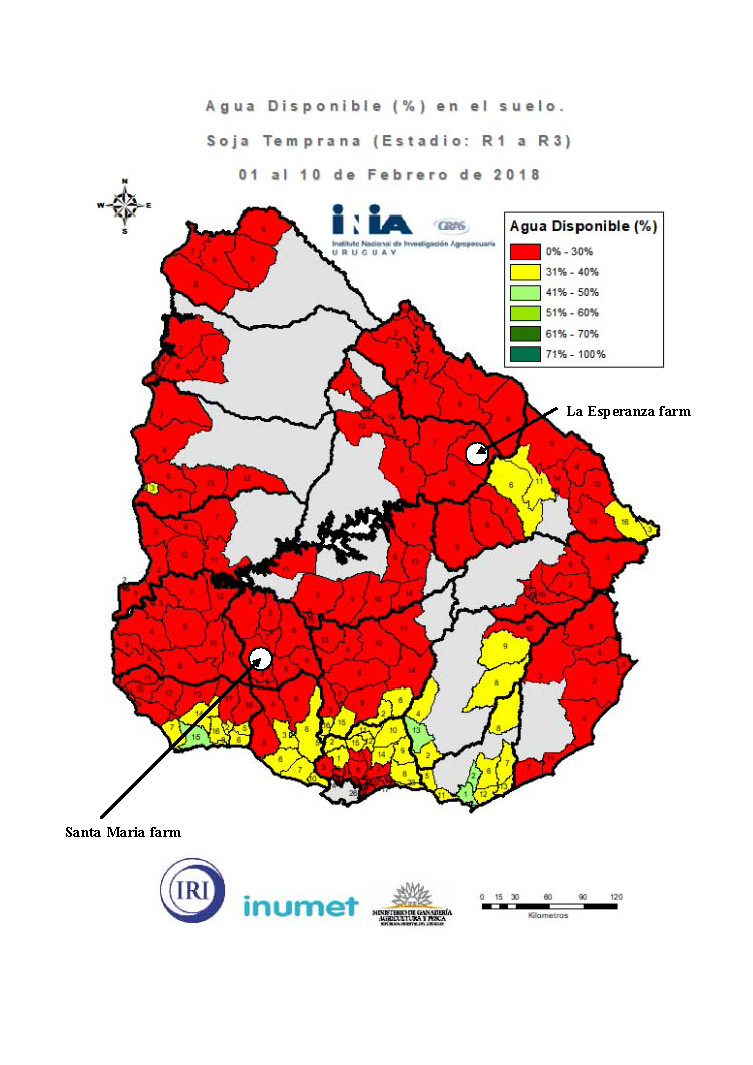

The situation is likely the same in Uruguay as you can see on the water availability map for the 10 first days of February.

For us, soybean is the most affected at La Esperanza farm (700 ha) but it is still too preliminary to quantify losses in yield or quality.

ARGENTINA – Local news: While grain transporters strike in Argentina, Brazil is downgrading its soybean and corn harvest expectations (February 2018)

Owners of trucks are currently striking to protest for higher freight rates and have slowed transport of grains to ports, cutting into stocks for wheat, corn and soybean.

The situation is particularly serious at Rosario port which will be the most affected as the complex is responsible for exporting 80% of agricultural products, and only 50% of the trucks currently arrive to the port.

Argentine exporters and crushers may not benefit from the expected downsize in Brazilian soybean and corn. Even if Conab (National Supply Company) increased recently his latest estimate of production for the current cycle thanks to better weather conditions (rain) – expected production for both grains should be down by at least 3% in terms of volume compared to last year.