PARAGUAY – Rice harvest has begun at Salitre Cue farm (February 2022).

Weather: The Situation remains unchanged as our region is still facing “extreme drought” conditions. No rain occurred since a while and we are registering high-temperature peaks.

Rice: On 25/01/22, we began to harvest our 1st block. So far, we have harvested 26 ha and got a preliminary yield of 5.7 t/ha with an index quality of 58 entire grain. Given our past year experience with similar conditions, we got a better yield and a much better quality in those plots than last harvest.

Water stress recorded over the past months affected the grain development in its blooming stage (unfilled grains) in some plots. We tried to manage water needs the best way we could and provide as much as possible water to each plots according to its irrigation stage with our artificial lake as the river was dry but our reserve could not always cover all optimal needs for the entire sowed area.

You can see below the difference of an optimal field we have and another affected by water stress. Meanwhile, we continue with the harvest of our other blocks as humidity of grains is going down very quickly given the heat weave faced, and we are expecting various yield deviation from the plan so as quality depending the plots/blocks.

Soybean: 250 ha of soy have been damaged by the extremely hot and dry weather. As you can see lots of flowers and grains in this area could not finish their normal development. Lost in yields have to be anticipated and we estimated an average yield of 1t/ha for this area versus 2.5t/ha projected.

Our situation is not unique as Paraguay’s Agriculture Ministry has just announced a 40% drop in soybean harvest this season for the country due to the unprecedented weather conditions. In some Paraguayan towns, some producers have already reported losses of 70% to 100% in some batches.

In addition to the agricultural performance, other considerations need to address the logistics situation. Most exports are shipped through the Paraná River, which suffered for the past 2 years from the worst downspout in the last 77 years.

The Paraná river is part of a significant trade circuit for several South American countries— namely Argentina, Paraguay, Brazil, Uruguay, and Bolivia. Many grain-bearing trade ships have had no other choice than to lower their carrying capacities to prevent interference from the increasingly shallow riverbed. This has raised significantly transportation prices and delivery delays.

ARGENTINA – Government reaches agreement with IMF to refinance USD 44.5-billion debt (January 2022).

After months of negotiations, President Alberto Fernández announced 28/01/22 that Argentina has reached a credit agreement with the International Monetary Fund that will allow the country access to new financing and buy it time to help it repay its USD 44.5-billion debt.

Without this new agreement, Argentina would have been faced with repayments, between principal and interest, of more than USD 9 billion in 2022, as much in 2023, and about USD 4 billion in 2024. Totally unsustainable, and the country would have been declared in insolvency on 01/02/22.

Argentina has pledged to slowly reduce its fiscal deficit and cut the Central Bank’s financing of the Treasury as part of an economic programme agreed with the IMF. The deal would also give Argentina at least a four-and-a-half year grace period before starting to pay back its debt.

According to Argentine representatives, the key points of the agreement are as follow:

1/ Argentina will aim for a primary fiscal deficit of 2.5% in 2022, 1.9% in 2023 and 0.9% in 2024,

2/ Plans to reduce Central Bank assistance to the Treasury to 1% of GDP in 2022, 0.6% in 2023, and “near zero” in 2024,

3/ Argentina will continue with FX policy currently in place, without large devaluation jumps,

4/ The plan targets USD 5 billion in additional foreign reserves in 2022,

5/ Government won’t seek labour reform or privatise public companies,

6/ Argentina will continue with price controls as part of its inflation strategy,

7/ Plan also targets positive real interest rates.

The agreement needs know to be approved by the Congress as well as by the board of Directors of the IMF. In summary, Argentina has done with the IMF the same thing it did in 2020 with private creditors: push the ball a little further ahead. To be followed…

ARGENTINA – Update on Curupi Pora farm activities (January 2022)

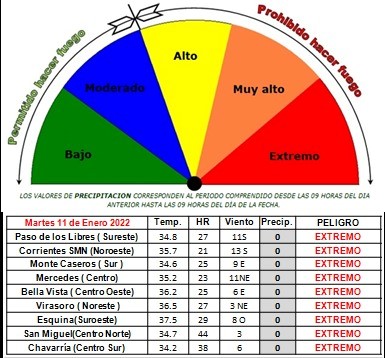

Situation/weather: Goodbye rain, hello heat wave! Temperatures reached stifling highs, exceeding 40°c in many provinces. Lot of cities are suffering from power cuts, creating chaotic situations (traffic, etc – see article from the Buenos Aires Times, dated 11/01/22). Hot, dry weather and low humidity levels are also creating dangerous fire conditions. Firefighters are already mobilized in 8 provinces to fight large fires.

We are not exempted in Corrientes region as the situation has been classified under extreme vigilance by the authorities for forest or brush fires (Article from Télam, dated 10/01/22).

Cattle operation: We have currently above 6,500 heads at the farm. Heat stress can strongly impact the animals at various levels (well-being, production, diet, fertility, etc.). To management this stress, we are adjusting food supply (silage, completed with corn and pellets).

Grassing area has reducing given the lack of water and the steria, sowed earlier this year, is hardly emerging. Thanks to a daily close control, the cattle is overall in good shape so far as you can see but beef production will be affected.

This year, we have subleased to a contractor 215 ha where corn and soybean have been sowed. We will be paid in kind as we need corn and soy to feed our heard. Both crop developments are heavily affected by water stress and the hot temperatures as you can see.

The drought, which is currently devastating crops across South America, has prompted swift cuts to forecasts for the soybean harvest in Argentina (the world’s biggest exporter of soybean oil and meal). The Rosario Stock Exchange has cut so far its estimate for the crop by 11%. The drought and hydrothermal stress have been so severe in the last 30 days that they rule out the possibility of a normal season. The last drought of the magnitude of this season’s, in 2018, cut at least 1% point from Argentina gross domestic product.

PARAGUAY – Update on Salitre Cue farm activities (January 2022).

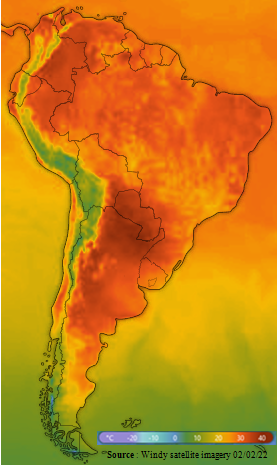

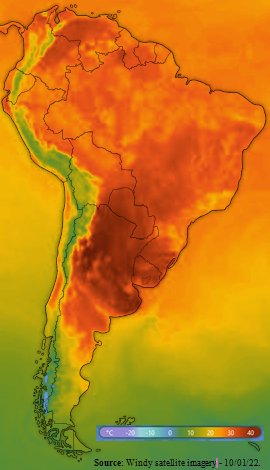

Weather/Situation: Our region is in “extreme drought” situation so as in southern Brazil or southern Mato Grosso do Sul and northern Argentina. Most part of the La Plata Basin suffers from heat waves and absolutely no rain as you can see on the satellite imagery.

The hydric deficit and above-average temperatures have already significantly damaged the 2021/22 soybean crop in the above mentioned area in Brazil.

Our river (a tributary to the Paraná River) where we use to pump water for our rice operation is almost dry.

Rice: The 560 ha sowed with rice are still under irrigation and we are forced to use our water reserve from our artificial lake to get those fields irrigated. As we sowed the fields in stages, the first 160 ha are going to be harvested by the end of this month. For now, we are able to maintain continuous flooding in the plots with the reserve water contained in our artificial lake but the high temperatures cause water to evaporate at a much faster rate.

Soybean: Among the 1,100 ha sowed, 150 ha of soy have been damaged by the extremely hot and dry weather. This stress scenario occurred in the middle of the flowering period; lots of flowers and grains in this area could not finish their normal development. Lost in yields have to be anticipated and we estimated an average yield of 1t/ha for this area versus 2.5t/ha projected.

ARGENTINA & PARAGUAY – Happy New Year 2022 (January 2022).

All Campos team is wishing you a happy New Year 2022!