PARAGUAY – Update on Salitre Cue farm activities (October 2021).

Weather/Situation: Despite the recent rains recorded, the level of the Paraguay River remains at an extremely low level continuing to greatly disrupt traffic on the river. According to the Paraguayan meteorological and hydrological authorities, the situation is far from being reversed in the short term and the river still continues to drop by an average of 2 to 3 cm per day, despite the recent rainfall. This situation disrupts not only the supplies of the agricultural operators (see previous posts) but also their operations. On top, disruption in supply and increasing prices of oil do not help either.

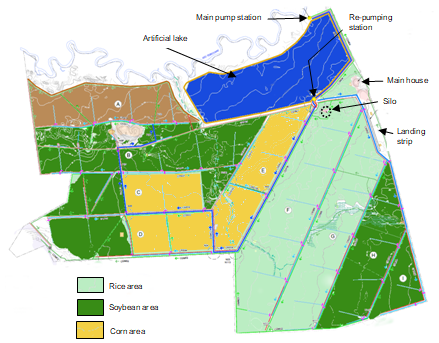

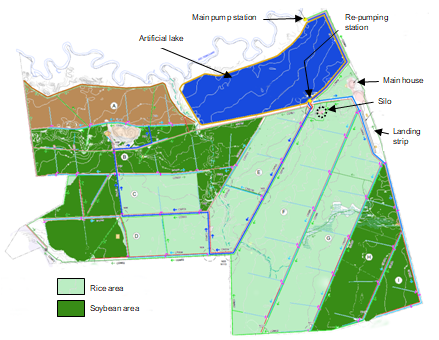

In our case, we are currently luckier as the recent rains enable to raise the level of the river enough to restart pumping directly to the fields as you can see. Our artificial lake which serves as water reserve in dry period is also fulfilled to its limit. We registered the heaviest rains in the country.

Rice: 160 ha of rice have been yet sowed. Due to rains, we had to stop but we are now restarting sowing in block F. You can see below the crop emerging on the surface already sowed. Last week of October, we will start to irrigate the block during 90 days.

In block G (450 ha) , we are going to apply herbicide to control weeds Subject to weather forecasts and water availability in the river for direct pumping, we will see in November with our partner GPSA if we are going to sow rice in this area. Under this scenario, we are going to sow 1,000 ha of rice this year. Otherwise, the herbicide applied will help to maintain the land clean and we will 560 ha of rice cultivation this year.

Soybean: We have started to sow soybean in block D and we currently maintain our forecasts to plant 1,100 ha with this crops.

You can see below some drainage channels build for the crop. Soybeans need good drainage for increased yield.

Corn: Rather than increasing the potential soybean area by reallocating rice surface in block E, D and F to soybean, we are analysis the opportunity with our partner to sow there corn in December given to good outlook for this crops and to diversify our risk/mix. We have under review the possibility to allocate 560 ha to this cultivation.

The climate requires us to be pragmatic with some kind of flexibility. Subject to weather conditions, we would be able this year to sow above 2,500 ha with 3 various crops (rice, soybean and corn).

ARGENTINA – Update on Curupi Pora farm activities (October 2021).

Situation/weather: The farm is currently in very good shape as we continue to register some good rains at the farm which allows the densification of the pastures. Those rains will also help to boost the development of the new pastures freshly sowed in September. We sowed 120 ha with Setaria pastures for grazing and for cut fodder.

This year, we have subleased to a contractor 150 ha where corn and soybean will be planted, and we will be paid in kind as we need corn to feed our heard. You can see below the good development of the corn which has been sowed.

Cattle operation: Our cattle herd (over 5,200 heads currently) is performing well and has a great uniformity as you can see. Below, you have some calves waiting for vaccination.

Here, you can see some young bulls.

PARAGUAY – Sowing season has started at Salitre Cue farm (24/09/21)

Sowing: On September 24, we began to slowly sow rice in block F as we didn’t have optimal soil conditions before (muddy ground). As the season is expected to be very dry, we are only planning for now to sow 560 ha of rice – subject to weather conditions, we will see later with our partner GPSA if we could add block G (450 ha more).

Once rice sowing will be completed, we will start to sow soybean. 1,100 ha have been developed and will be sowed with soybean for the 1st time in October. Here also – subject to weather conditions, we will see with our partner GPSA if we could reallocate 460 ha of rice surface to soybean. Our options depend on weather conditions (rains) and whether or not we will be able to put water from the river or not.

Sowing period started later this year as all producers have to face extra delays in the delivery of their inputs and seeds by barge as the traffic on the Parana River is very slow because of the shallow draft (see previous post). In addition, increases in fuel and fertilizer over the past year will have a strong impact on production costs.

In the US for example, the rice planted area will significantly decrease this year due to the poor gross margin of the activity. Meanwhile some Asian producers like Vietnam, which have recorded better yields than expected, are currently facing disruption due to container shortages and pandemic-led restrictions. We are expecting another complicated season, mainly due to weather.

ARGENTINA – Update on Curupi Pora farm activities (September 2021)

Situation/weather: After having faced dry and warm weather, we registered some good dense rains of 45 mm. Timely intense thunderstorms appear to be partially but violently offsetting below-average rainfall in the north of the country. The level of Santa Lucia River which is bordering the farm went up and as we maintain the riverside completely clean the cattle can go to the river, drink water and come back to the plots.

Silage and pasture program: Pastures have improved their density and as part of our strategy, we are in the process to sow around 120 ha with new pastures (setaria). Setaria is a permanent pasture for grazing and for cut fodder (ie comfort of handling by virtue of the soft foliage and absence of foliar bristles). You can see below the land preparation performed for the coming sowing of this pasture.

Cattle operation: Our cattle herd (over 4,900 heads currently) is in very good shape as you can see for the various categories, thanks to the efforts of our farm team.

Here, you can see some cows and heifers with their babies.

Here, you can see some heifer calves.

Here, you can see some heifers of 2-years which are going to be in service in November.

We are also in the process to delivery 23 bulls and 25 cows.

This will complete our cattle sales for the month as we have anticipated them due to the export restrictions set up again by the Argentine authorities. Due to those restrictions, beef prices have declined by 1.4%. This measure is blocking a great export opportunities for the country as “mad cow” cases have been identified in Brazil which triggered the immediate temporary suspension of beef exports to China and Hong Kong (Article from El Cronista, dated 13/09/21).

Argentina – Mid-term primary election results (September 2021)

Argentina’s government suffers heavy defeat in PASO primaries which took place on 12/09/21. The ruling Peronist coalition (Frente de Todos) lost heavily in the key province of Buenos Aires Province, the movement’s traditional heartland, while recording notable losses in Buenos Aires City (together, they make up almost 40% of Argentina’s population) as well as in other major provinces like Córdoba, Santa Fe, Corrientes and Mendoza, piling pressure on President Alberto Fernández and his government. Unexpected, and unwelcome, defeats then came in Chaco, Jujuy, Santa Cruz, La Pampa and Chubut. Frente de Todos also fell in Entre Ríos, Misiones, Salta, Tierra del Fuego and San Luis. In Neuquén and Río Negro, the ruling coalition lost to local parties.

The primary election serves as early test on the political strength of President Alberto Fernández’s ruling coalition. Voters will pick candidates to lead their parties or coalitions ahead of the final midterm vote on November 14, when 50% of the lower house seats in Congress and a 1/3 of the Senate are up for election. If the same results were to be repeated in November, Frente de Todos would lose six senators and its majority in the upper house. In the lower house, its bloc would drop from 120 to 111, versus 118 for Juntos por el Cambio. It could also provide some early signals into the 2023 presidential race.

Despite an array of parties running in the primaries, Argentines are largely split between Fernandez’s populist coalition, Frente de Todos, and the more investor-friendly opposition, Juntos por el Cambio. Fernandez’s government never gained credibility in the eye of foreign investors after a series of anti-business decisions including defaulting on its dollar debt and tightening capital controls.

Investors and markets will cheer on Frente de Todos heavy defeats: Argentine stocks traded on Wall Street soared prior to the opening of the market on September 13 and the country risk fell. But in the short term, an open question remains whether this election loss is going force Mr Fernandez to be more pragmatic, or instead double down on unorthodox measures to rile up his base. To be continued …