PARAGUAY – Paraná river at historic low (September 2021).

The Paraná, with the world’s 10th largest river basin, has dropped to its lowest levels since 1940. Experts doubt whether it will recover the exuberance which made it the main thoroughfare of Mercosur integration, even after the rainy season in December.

The decrease in recent months has become so drastic that it is affecting merchant shipping, the generation of hydro-electric power, fisheries and the supply of water for household consumption and irrigation while modifying its geographical relief, water and river-bed in ways which nobody dares to venture will be permanent. Some 4,000 barges, 350 tugboats and 100 container carriers are waiting for the river level to rise, causing significant cost overruns for the transport of fuel, fertilizer, food and other imported goods. Around 85% of Paraguay’s foreign trade is conducted via the river.

As our farm is situated along the river Tebicuary (a tributary to the Paraná River), the situation is even worse in terms of water availability, and our business is highly depended on water (water pumped from the river should be kept standing in the rice field throughout the growth period). Given the high probability of a coming strong drought, we decided to reduce our rice sowing plan to around 600 ha (vs 1,750 ha). However, we will complete our mix by sowing 1,100 ha of soybean with corn as double crops. This area has been developed over the last 6 months. Soybean and corn do not need permanent irrigation as rice, only rainfalls and those crops have a different sowing season than rice. Subject to weather evolution in the coming months, we will be still able to add more surfaces to soybean cultivation by reallocating some unused rice surface to this crop.

ARGENTINA – Government extends beef export limits to end of October (September 2021).

On 31/08/21, the Argentine government has extended beef export restrictions until the end of October. Exports will remain limited to half the 2020 average.

Fernández administration said that those restrictions are an attempt to moderate skyrocketing domestic prices as according to authorities, increases in the price of meat helped boost inflation to 51.8% year-on-year in July.

Argentina is the 4th largest exporter of beef in the world with some 897,500 tons of beef and cow leather worth USD 2.7 billion in 2020, and one of its biggest consumers per capita. But poverty affects 42% of the population, and the government is trying to reduce the cost of living by implementing price controls. In May, President Fernández’s government slapped a one-month suspension on foreign meat sales. In June, it announced a progressive resumption of exports but limited to 50 percent of last year’s average monthly volumes until the end of August.

Producers reacted angrily to the news: “ideology overcomes rationality, impoverishing everyone” said by Mr Pino, leader of the La Sociedad Rural. The business chamber claimed in a recent report that meat producers had lost out on trade worth more than USD 1.084 billion since ban on exports were imposed. In reaction, a strike to stop beef supply will probably occur after primary election on next September 12.

As beef producer (7,500 heads of cattle), we don t see positively this news and we will try to complete our remaining planned cattle delivery before the strike.

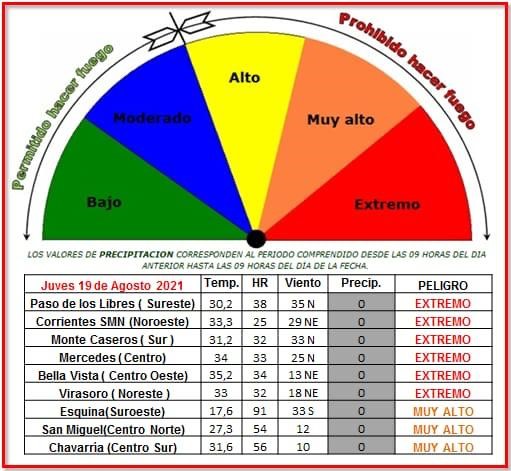

ARGENTINA –Lack of rains, heat waves and wind in Corrientes farms (August 2021).

Currently, we have all the elements of an explosive cocktail combined in Corrientes which could potentially affect our farms, mainly our forest: Lack of rains, heat waves and wind. The level of the river Santa Lucia which is bordering our farms is very low. Rain is rare but high temperatures are frequent currently.

The region of Corrientes has been classified in extreme vigilance by the authorities for forest or brush fires.

In addition to the deep cleaning operation we have performed after last year fires in Tata Cua forest, internal roads have been extended and all sections bordering roads have been cleaned to prevent from a new fire.

We also uproot palm trees near our tree plantation because in case of fire, they play a role of combustion gas pedal.

In Curupi Pora farm, our cattle herd (over 4,900 heads) are for now in very good shape even if the grassing area have reduced due to the ongoing weather conditions.

Our big natural lagoon where cattle come to drink and to refresh looks currently empty. We made also reserves in silage as a scorching summer is forecasted like in 2008.

ARGENTINA-PARAGUAY-URUGUAY – International crops market (August 2021).

The evolution of the sector is interesting to monitor for cattle producers like us as it foreshadows the price and volume of some consumables for livestock.

International 1-year wheat prices (USD/Bu):

Wheat: Prices have risen but have not yet reached the record levels of 2011 and 2012. Recent increase due to the drought effect in the USA.

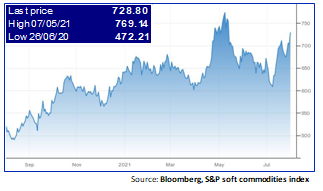

International 1-year corn prices (USD/Bu):

Corn: +72% since June 2020. Improvements in growing conditions in Europe and the USA, and increased yields in Argentina and Brazil leading to a downward correction in prices.

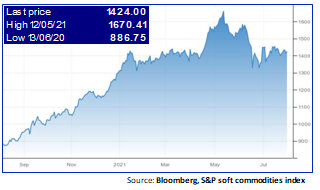

International 1-year soybean prices (USD/Bu):

Soybean: +70% since June 2020. The new surge in prices is not like in 2012 solely linked to the boom of agro fuels.

What are the drivers?

A dynamic demand led by China: China imported a record 32 million tons of grain and 100 million tons of soybeans in 2020, and continues to import corn at an unprecedented rate. With the pandemic, importing countries have increased their strategic reserves to avoid supply disruptions.

Tensions linked to export restrictions: export taxes and quotas instituted by producing countries to contain domestic prices (Russia, Ukraine, Argentina) are also increasing the pressure on prices.

Concerns about the level of world stocks: -10% for corn and -22% for soybeans in forecasted for 2020/21.

The drought which has affected Europe, USA, Brazil and Argentina (La Niña).

Weakening emerging currencies against the US dollar has favoured exports.

…World meat prices are only starting to follow crops prices increase. This delay in revaluation is explained by the importance of food costs, which must necessarily be reflected in prices.

ARGENTINA – Trees measurements and cuts at Tata Cua forest (July 2021).

As part of our fiscal year end closing procedures, we are currently performing to the inventory of our trees. The process is starting late this year as we are facing logistic delays due to the pandemic.

A forest expert is taking measures such as the height and width of the trunks to calculate the volume of wood in the forest. This information serves to define whether or not the forest is ready for harvest but also to follow the good growth of the trees and identify which plots have to be cut.

In our case, its essential as we faced last year in August a fire (see previous post related). Trees which have been affected by fire have to be cut as their development is compromised and they take space of others that are healthy or regrowing.

Approximately 43 ha of pine trees have being sold to wood products manufacturers over the year (cuts are still in progress).