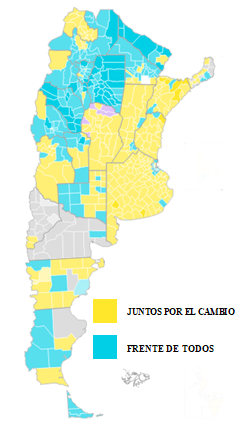

Already in the minority in the lower house Chamber of Deputies, Fernández’s Frente de Todos coalition looks set to drop from 41 to 35 seats in the 72-member Senate, based on projections with more than 98% of votes counted in the midterm elections held on 14/11/21.

According to a breakdown published by La Nación newspaper, the opposition Juntos por el Cambio coalition took 41.97% of the national vote (all votes cast), with the ruling Peronist coalition on 33.57%. The opposition, which will now gain ground in both chambers of Congress, scored key victories in Buenos Aires City and the provinces of Buenos Aires, Córdoba, Mendoza and Santa Fe, regions that carry a lot of electoral weight. Juntos por el Cambio also emerged victorious in the provinces of Jujuy, La Pampa, Chubut, Corrientes, Entre Ríos, Misiones, San Luis and Santa Cruz.

Mr Fernández will now likely be forced to make concessions to the opposition during the last two years of his mandate in order to pass laws or make key appointments. Even if the more investor-friendly opposition gained power, the country will face economic turbulences in the coming months. Among others, Argentina is in a tricky renegotiation with the I.M.F. over the repayment of a US 44 billion debt. If no new repayment schedule is found, Argentina will have to repay US19 billion in 2022 and as much again in 2023. Let’s see some light despite all the darkness… Mrs Kirchner will no longer have a bloc in the Senate that guarantees she can pull the strings at her own pace.