Talks to restructure more than $65 billion in foreign debt seemed to have hit a wall as one of the main groups of bondholders is now evaluating his option to seek repayment in the courts. Officials and creditors failed to find common ground after 2 bondholder groups submitted an offer before the latest deadline. Argentina has set a deadline of June 19 on its latest proposal after extending it 4 times, but the deadline doesn’t have tangible impact since the country fell into default on May 22 after missing overdue interest payments of $500 million (please refer to previous posts).

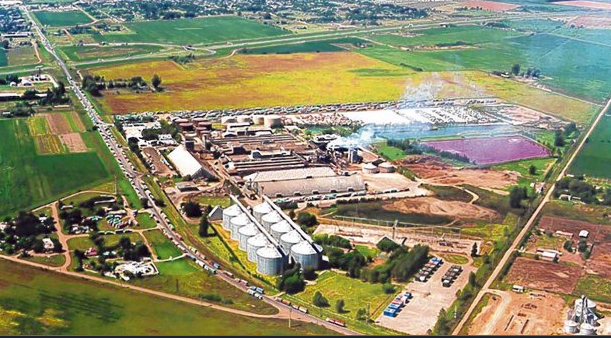

As tensions mount, the government is considering all possible options, among them asking the International Monetary Fund for a new programme sooner than previously planned or using payments tied to agriculture exports. Farmers are lobbying against Economy Minister’s Martín Guzmán proposal as “A measure like this would mean export taxes couldn’t be scrapped until the bond matures”.

The farm industry is key for tax revenues and to bring in dollars: Argentina’s crop exports were valued at $23.7 billion last year.

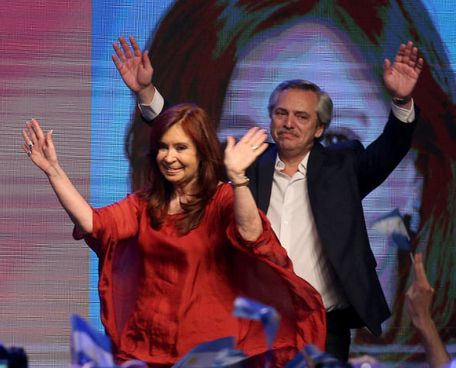

President Fernández hiked export taxes already 6 months ago when he took office. More recently, the central bank has taken steps to prompt farmers to sell their soy harvests. Dual foreign-exchange rates are also driving concerns about input prices which are becoming very expensive, and we previously talked about Vicentin expropriation. Ultimately, authorities are trying to manage farm products exports and to get their dollars. What comes next…and for now, the new deadline has been set for July 24.