Argentine voters soundly rejected President Mauricio Macri’s austere economic policies in primary elections on Sunday 11/08/19, casting serious doubt on his chances of re-election in October.

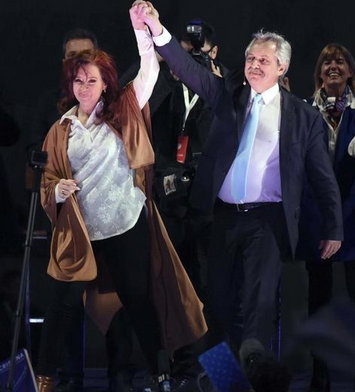

A coalition backing opposition candidate Alberto Fernandez (Center-left) – whose running mate is former president Cristina Kirchner – led by a wider-than-expected 15 percentage points with 47.3% of votes, with 88% of ballots counted. Pro-business Macri registered 32% of the votes and centrist former finance minister Roberto Lavagna a distant third with just 8.3%.

If Fernandez was to register the same result in October, he would be president as Argentina’s electoral law requires a candidate to gain 45% for outright victory, or 40% and a lead of at least 10 points over the nearest challenger.

Macri’s chances to get a second mandate appear all but over. His camp has lost popularity due to a deep economic crisis which drove the inflation rate to nearly 50% last year and slashed Argentines’ purchasing power. He was taking the necessary, painful steps to get the economy going after 12 years of leftist populism under Cristina Kirchner and her predecessor and late husband, Nestor Kirchner but the electorate issued a resounding rejection of his handling of the economic situation.

On the other side, the markets have little faith in Alberto Fernandez, who is widely seen as dependent on Cristina Kirchner. The possibility that Cristina Kirchner could return to power put markets on edge due to the prospect of heavy state interventionism and protectionism. On top of that, Mrs Kirchner is currently still facing a series of trials for corruption (a dozen) during her 2007-2015 administration. She denies all the allegations.

There could be an even stronger degree of market volatility given the spread in the results. At market opening on 12/08/19, The Argentine peso plunged already by 5.1% to 48.50 per US dollar … it could turn into a hectic trading day for Argentina.

To be followed: The 1st round of the presidential election will be held on October 27, with a run-off set for November 24, if needed.