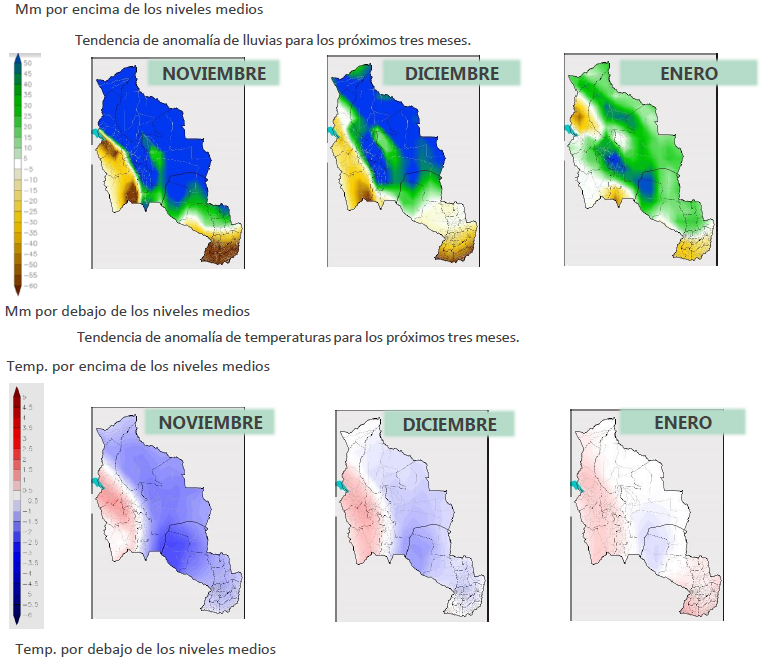

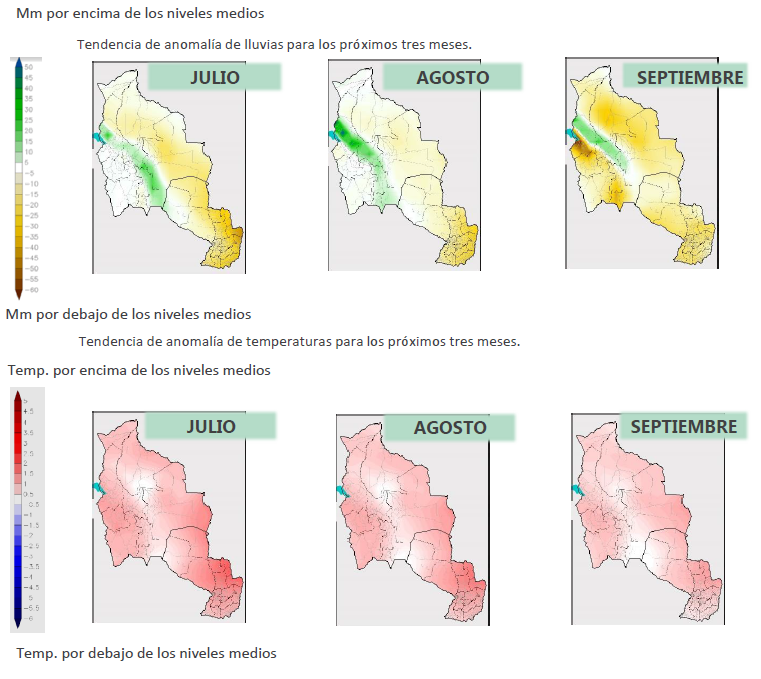

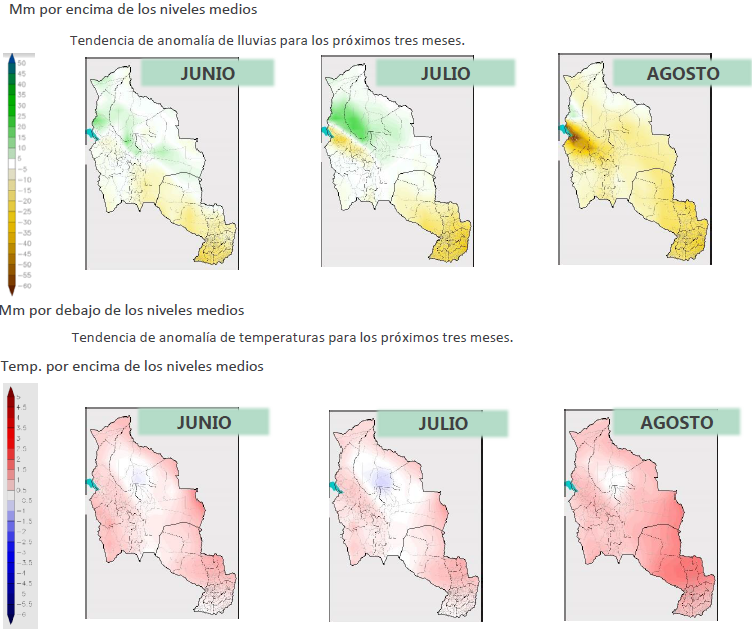

Situación climática: Aunque el pronóstico del tiempo sigue siendo muy preocupante para la temporada (ver mapa meteorológico a continuación), por el momento somos muy afortunados porque recientemente hemos registrado buenas lluvias abundantes como se puede ver.

Esas lluvias nos ayudaron mucho al aumento del nivel del rio y podemos volver a bombear agua directamente desde allí para regar el arroz sin usar nuestra reserva de agua en nuestro lago artificial (retroceder en caso de período de estrés hídrico). Esperamos que estas condiciones se mantengan durante los próximos meses (etapa de floración cuando se llenan los granos).

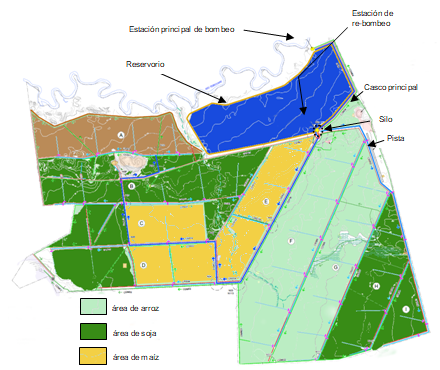

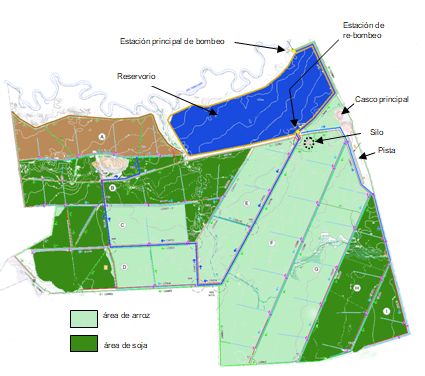

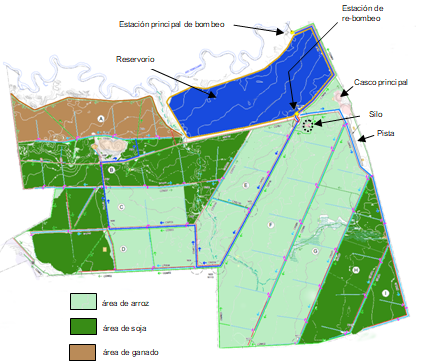

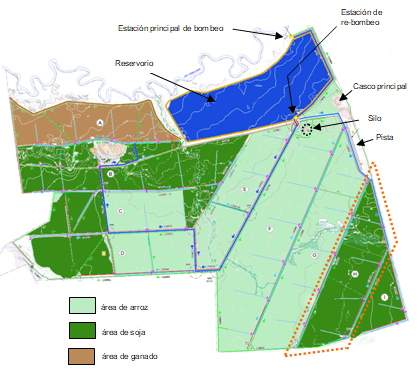

Soja: Al momento se han sembrado más de 800 ha y se están desarrollando muy bien, como puede ver. Mantenemos nuestra previsión de sembrar 1.100 ha.

Arroz: Finalizamos la siembra de 560 ha. Las primeras parcelas sembradas se están desarrollando bien por ahora. Estamos en la 1ª etapa y comenzaremos a principios de diciembre con la 2ª etapa, cuando las plantas sean lo suficientemente grandes para soportar inundaciones poco profundas. El ciclo completo de riego de los cultivos dura 90 días y es importante mencionar que la inundación continua de agua proporciona el mejor entorno de crecimiento para el arroz.

No vamos a sembrar arroz en el bloque G (450 ha) debido a las incertidumbres climáticas y el nivel extremadamente bajo en el río Paraguay ha retrasado fuertemente el suministro de todos los insumos. En consecuencia, es arriesgado comenzar a sembrar arroz en este bloque. Nos quedaremos con 560 ha de arroz para esta temporada.

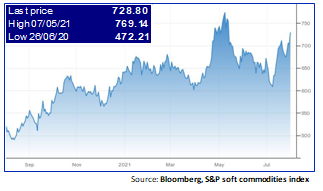

Maíz: Como expresamos antes y en lugar de aumentar el área potencial de soja reasignando la superficie de arroz a la soja, hemos iniciado una negociación con un tercero para el arrendamiento de nuestra superficie disponible (hasta 1,000 ha) para cultivar maíz. Este será un escenario de 1 año; La situación meteorológica nos obliga a ser pragmáticos. La perspectiva para el maíz es atractiva y nos permitirá diversificar nuestro riesgo / mix.

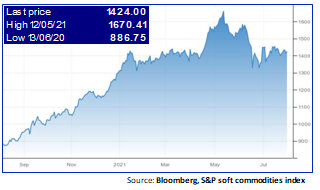

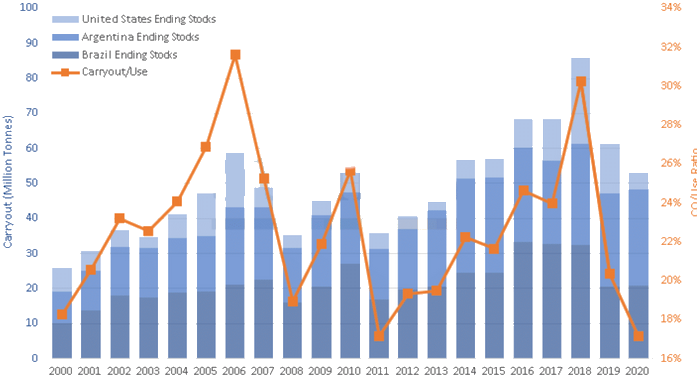

Fuente: Bloomberg

Fuente: Bloomberg