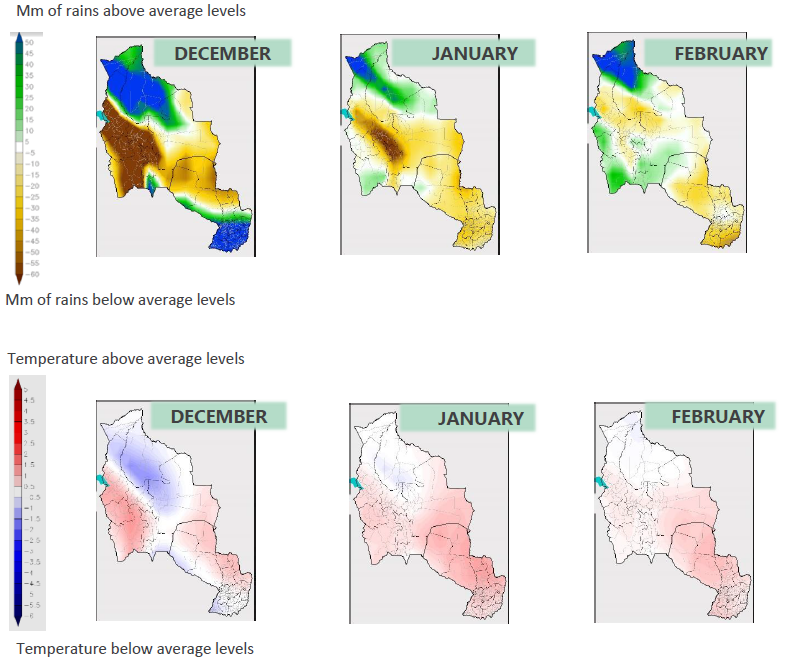

Situation/weather: We are back to a more normal situation in terms of weather. Last week of March, we registered some rains which allow us to begin again pumping water from the river (restrictions set up by authorities have been lifted) in order to fulfill our artificial lake used as water reserve.

Due to the intense drought period we faced earlier this cycle, we were forced to use all our water reserve to irrigate the rice fields. However, it was still not enough as we report it previously.

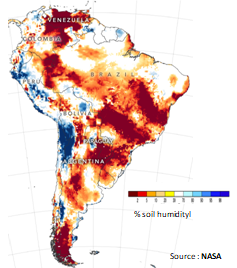

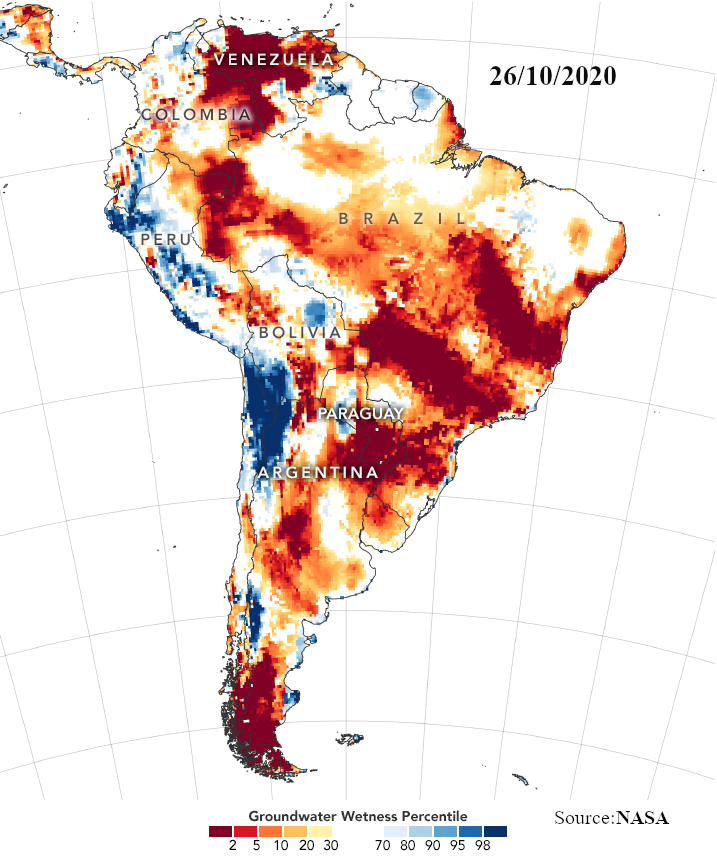

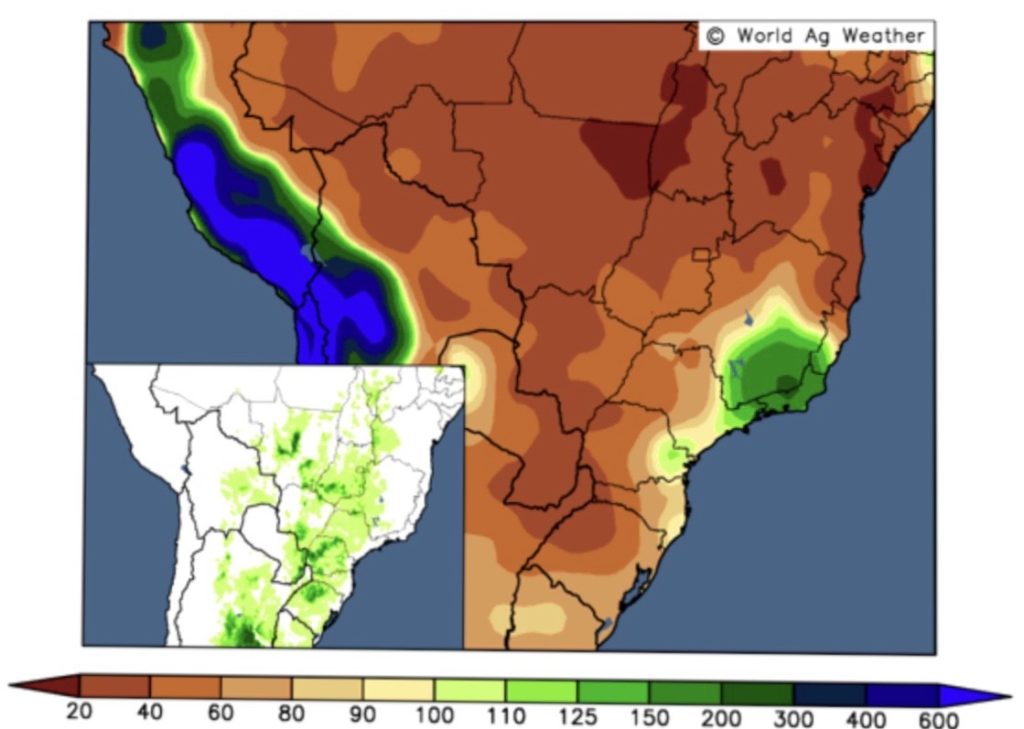

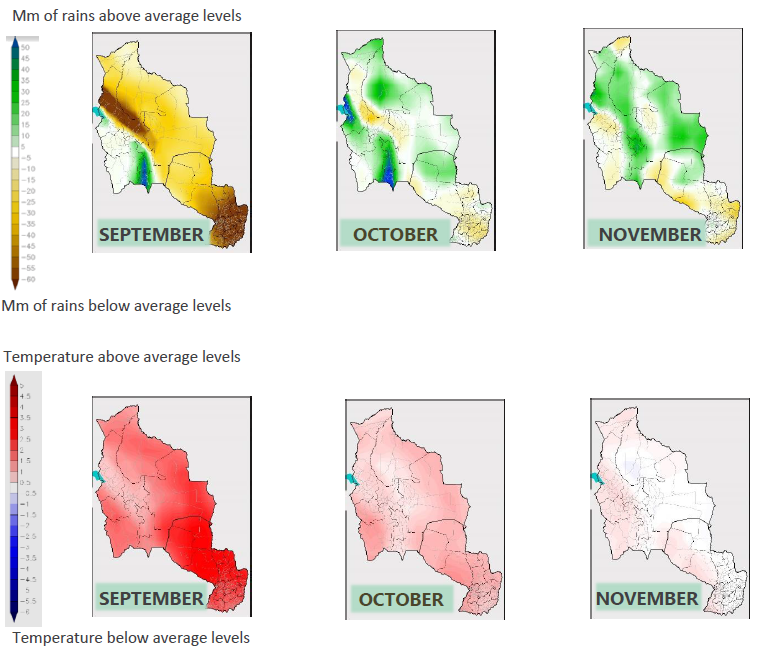

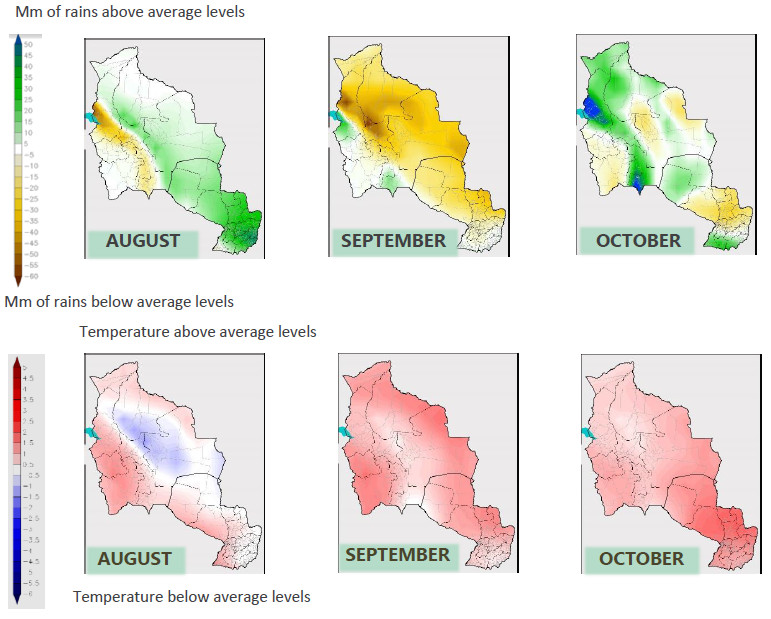

Drought situations in Latam (26/10/20)

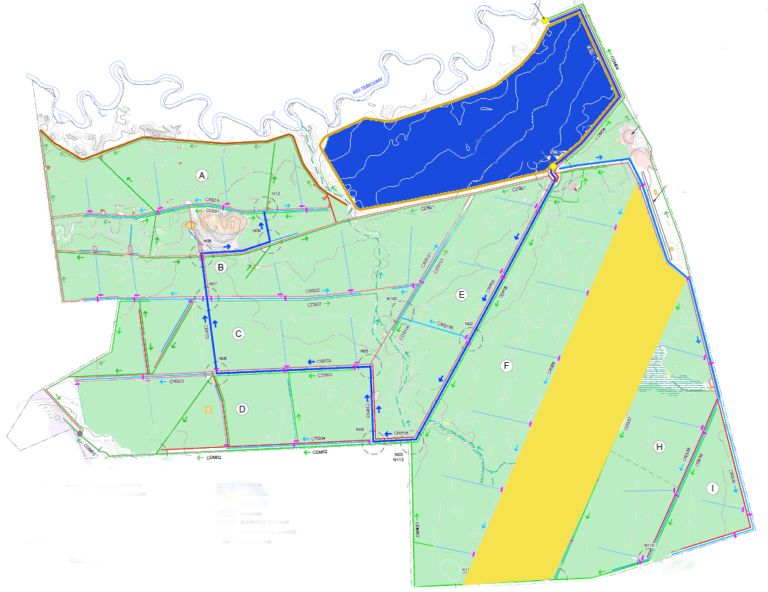

Harvest: Harvest and drying process have been completed. Among the 965 ha which could be sowed (vs 1528 ha budgeted), we could only harvest first stage of sowing on 538 ha. We could temporarily irrigate our first block of sowing thanks to our artificial lake but not the 2nd stage which we had to abandon (see previous posts).

We have produced 2,763 tons with a yield of 5.1 t/ha and an average quality index of 42%. We have sold almost all rice stored in our silos, and we could sold it at a peak price of USD 250/t. However, we are far from our objectives this year; it was a very challenging and disappointing campaign for us so as all the rice producers.

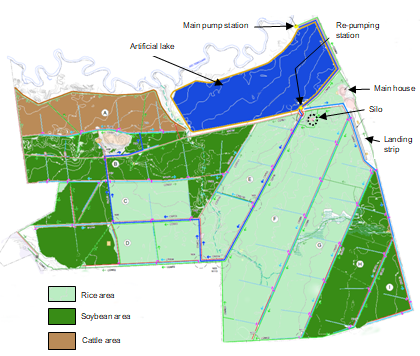

Diversification: For diversification purpose, we agreed with our partner to add soybean cultivation to our mix. We are planning to develop with our partner 1,100 ha of soybean at the farm over the next 3 years.

The farm will then have a modular double production: 1,600 ha dedicated to rice cultivation and 1,100 ha dedicated to soybean cultivation. Soybean and rice have not the same momentum of production and soybean production does not require irrigation like rice. Furthermore, this crop has great outlook. China imports the most soy and is expected to significantly increase its import of the commodity. Soy is pervasive in our lives. Not only are soybeans made into food products like tofu, soy sauce, and meat substitutes, but we also eat them in the form of soybean oil and soybean meal. Soybean meal is widely used as animal feed, so we humans consume much of it indirectly via our meat and dairy.

You can see on the farm map our productive area of which 2,840 ha are dedicated to crops production (adjustable) and 270 ha may be allocated in a near future to a cattle breeding activity. We are going to start land preparation of soybean and rice in early April.

Source: Bloomberg

Source: Bloomberg

Market: Locally paddy rice price rise recently in Brazil (+17% month on month in real). The weakness of the real, which reached a record low at 5.89 per dollar on May 14, has sharply increased the competitiveness of Brazilian paddy exports. Additionally, extremely tight paddy stocks in the US South have meant that Brazilian exporters have faced little competition selling to Central America and Venezuela this year. During the first half year, exports went up by 79% year on year. Meanwhile, the weak real has hindered imports, which went down by 12% year on year during that period. So Brazilian mills are now buying from neighbouring countries (Paraguay, Argentina and Uruguay) to supply the domestic market and protect their market share. This drives up paddy prices.

Market: Locally paddy rice price rise recently in Brazil (+17% month on month in real). The weakness of the real, which reached a record low at 5.89 per dollar on May 14, has sharply increased the competitiveness of Brazilian paddy exports. Additionally, extremely tight paddy stocks in the US South have meant that Brazilian exporters have faced little competition selling to Central America and Venezuela this year. During the first half year, exports went up by 79% year on year. Meanwhile, the weak real has hindered imports, which went down by 12% year on year during that period. So Brazilian mills are now buying from neighbouring countries (Paraguay, Argentina and Uruguay) to supply the domestic market and protect their market share. This drives up paddy prices. Source: ESALQ

Source: ESALQ