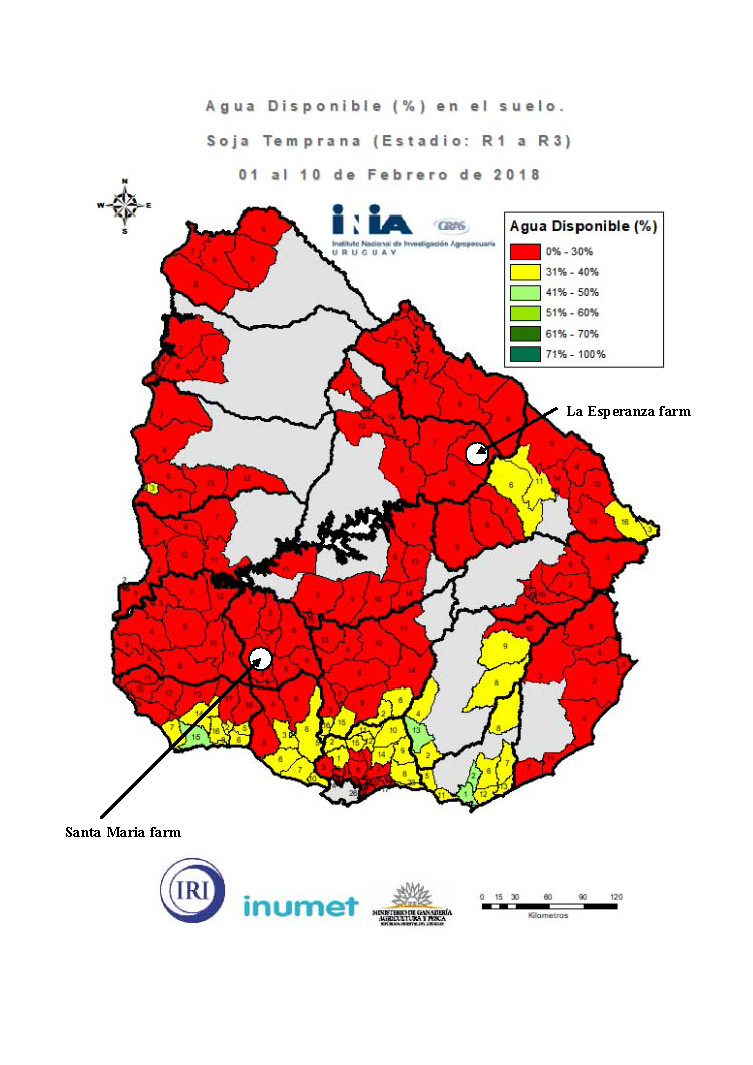

Since the beginning of 2018, there has been a significant reduction in availability and access to water due to a deficit caused by a lack of rain, which has been further affected by the La Niña phenomenon.

This situation has led to the worst drought conditions faced in Uruguay since 2008/09. Local industry officials anticipated economic losses exceeding $500 million, which would rank as that nation’s most expensive disaster in history. The Uruguayan government had to declare an agricultural emergency due to drought in 14 departments in order to support family farmers (no more then 500 hectares of land to be eligible).

For us, both of our Uruguayan farms, located among the most affected departments in the country, have suffered from the prolonged drought, damaging corn and soybean production as well as cattle operations. So far, Santa Maria farm (Flores) was the most affected.

Rainfall register: Cumulative rainfall for July-March period was 737 mm, -32% compared with the historical average for the same period. During the critical month of February where corn and soybean are in blooming stage, we register only 30 mm of rain Vs 143 mm as historical average. This trend was not reversed with 26 mm registered vs 143 mm historically.

Winter crops: 374 hectares were sowed and we get 1,5 t/ha vs 3,5 t/ha Budgeted. Climate vagaries have affected production: Excess rainfalls of August and lack of water during maturity season (November/December).

Summer crops (Soybean & Corn): Around 500 hectares of soybean #1 have been sowed with delay due to soil conditions. So far, over 220 hectares have been harvested with a preliminary yield of 1.8 t/ha vs 0.6 t/ha to 1.9 t/ha in our area. Double–crop soybean over 400 hectares was done but harvest did not started yet – expected yield should be around 1t/ha vs 1.8 t/ha budgeted.

As for corn, we are going to start soon with the harvest and in terms of yield, we expect to get around 3 t/ha vs 5,5 tons/ha budgeted.

Cattle activities: Pasture to feed the herd have evaporated due to the drought forcing us to place the calves in the feedlot and supplement them with corn. pregnant cows are also going to be supplemented as pasture are to poor in the field. Those more sensitive categories have to be management in priority.

For now, we can mitigate the impact of the drought on pastures by supplementing the herd with silage and corn. However, cattle operations are going to be affected next cycle as pasture are not going enough time to recover and their sowing period is behind us.