President Alberto Fernández announced on June 8 in the evening that the government will intervene and expropriate bankrupt agricultural giant Vicentin. The President said the move to save the bankrupt agro-export giant was predominantly motivated by a wish to save jobs: “We are going to come to the rescue of Vicentín and defend its 2,600 workers,” and added “Around 2,600 local producers can still count on a company that will be able to trade their production.”

The government will take control of Vicentin for the next 60 days as it seeks congressional approval to expropriate the agricultural powerhouse, which filed for bankruptcy last year after being caught out in currency swings. Vicentin’s fate has been closely tied to politics. The company expanded under the presidency of market-friendly Mauricio Macri and then fell into disarray when Fernandez emerged as his likely replacement.

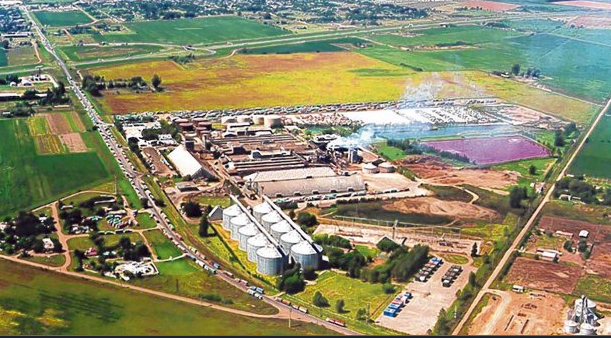

Vicentin is a family company with 90 years in the business, which started facing severe financial issues in 2019.The company defaulted on about $1.5 billion of debt last year. A court in Santa Fe province, where the company is headquartered, has been overseeing a bankruptcy in a procedure that’s similar to Chapter 11 in the U.S. A big part of Vicentin’s debt is owed to state-run Banco Nacion. But the expropriation plan was still a surprise to company executives, who’ve been in talks with existing partner Glencore Plc and other companies, a spokesman said. Switzerland-based Glencore has a joint venture with Vicentin called Renova, which includes one of the world’s biggest soy-crushing plants with 20,000 mt of daily crushing capacity. However, Fernandez said it was too soon to say how a new state partnership with Glencore would work.Gabriel Delgado, who was an agriculture secretary under Kirchner, will lead the government’s intervention of Vicentin. Assets will be placed in a trust to be managed by the agriculture department of state-run YPF SA.

This surprised announcement raises again another question: Who exactly is governing Argentina? Fernandez, who’s far from a free-marketeer but viewed as a moderate, or his deputy, Kirchner, a figurehead for fervent supporters of Latin American leftism and nationalism.

The move comes at a delicate time for Argentina, which is negotiating a restructuring of $65 billion in overseas debt. It also revives memories of the 2012 nationalization of YPF and other companies during the presidency of Kirchner, and raises questions about how Argentina will lure private-sector investments to lift its economy off the floor.It s also worth to remind that Mrs Kirchner never forgot the Argentine farmers strike in 2008 over levies on exports which almost forced her to resign, and also recalls that many farmers (those who could) would prefer to hold on to their crops, until they could have access to a more transparent foreign exchange market for the US dollar. To be followed …