The European Union and the South American trade bloc Mercosur (Argentina, Brazil, Paraguay and Uruguay – Venezuela is a full member too but has been suspended since 2016) reached a free-trade agreement on 28 June 2019.

The deal impacts a combined population of more than 780 million people (world’s biggest free trade area), and would save more than USD 4.5 billion worth of duties per year, according to European Commission President Jean-Claude Juncker. Both sides currently trade over €88 billion in goods and €34 billion in services each year.

The agreement is broad, covering both tariff and regulatory issues, including services, government procurement, trade facilitation, technical barriers, sanitary and phytosanitary measures, and intellectual property.

The agreement also opens up the EU market to goods from Mercosur. Of the EU duties on imports from Mercosur, 92% will be eliminated over a transition period of up to 10 years. However, the EU will limit imports of sensitive agricultural products such as beef, ethanol, pork, honey, sugar, and poultry; and these products will have to comply with the EU’s standards.

Cattle outlook: A new 99,000 ton annual quota for beef exports to EU member countries will be assigned to Mercosur and large South American livestock farms will be competing with smaller local cattle producers.

Another example with rice: Argentinean and Uruguayan producers (mainly) could further weaken the European rice market. In fact, rice from Mercosur countries is round grain, the same kind that is produced in the Spanish Levant. This would likely put Spanish farmers at a disadvantage given that the Mercosur rice would likely come at lower prices. This might create new market opportunities for those countries other than Brazil.

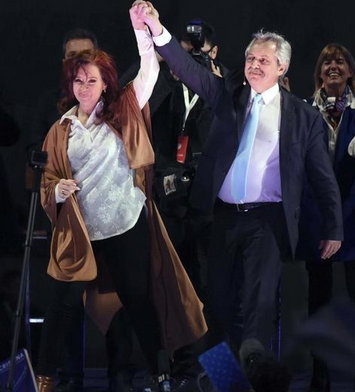

The list goes on but the agreement still needs to be ratified by the national parliaments of all member countries of both blocs, as well as by the European Parliament and EU Council. It may take 2 to 3 years before being effective. However, if Mr Macri loses the October presidential election to the leftwing populist ticket of Mrs Kirchner and Mr Fernández, there is a risk Argentina may opt not to stay in.

Bottom line, this agreement will create new opportunities for Mercosur farmers and might force to evolve the current predominantly farming family model across the EU to more modern sustainable industrial agricultural units or groups.