Argentines face the prospect of 90% inflation by year end after the brutal resignation on 02/07/22 of is economy ministers. The dramatic exit of Martín Guzmán this month led to price mark-ups by many businesses. Some Argentines raced to the shops the morning after Guzmán quit, to try to stock up ahead of peso devaluation and price hikes. The Central Bank comes under pressure to let the peso depreciate more rapidly.

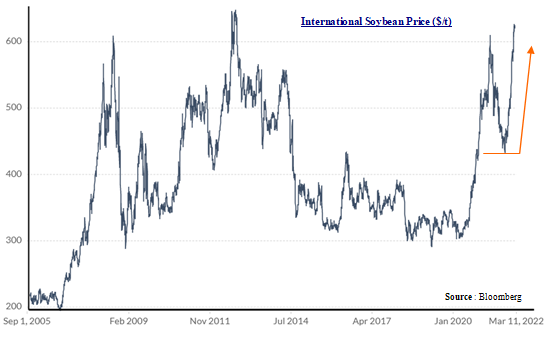

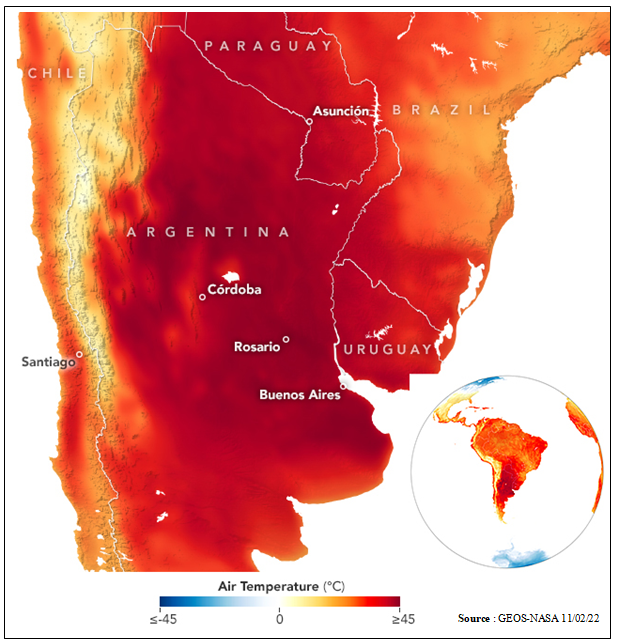

Consulting firms in Buenos Aires, such as EconViews, FMyA, Alberdi Partners and EcoGo, are now predicting 2022 year-end inflation of 90%. That would be the fastest pace since hyperinflation three decades ago, and the highest rate in the world outside Venezuela and Sudan, according to forecasts from the IMF. Farmers are also hanging on to more of their crops than normal to defend against inflation. Growers have long used hoarding to shield against Argentina’s notoriously volatile economy, especially gyrations in currency and export taxes. But this year, spiraling inflation is exacerbating the dynamic (less than 45% of the global soy harvest has been sold).

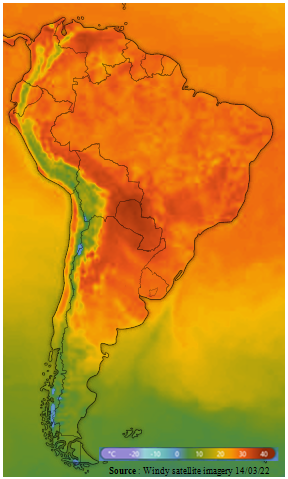

More hoarding signals slower shipments of soy oil and soy meal at a time when food supply chains are already heavily disrupted by the lingering impact of the pandemic and the war in Ukraine. It also curtails hard currency flows to Argentina which exacerbate his debt problem. It’s a very volatile situation.