ARGENTINA – Update on San Bartolo farm activities (October 2020).

River cleaning: Maintenance and adjustments work performed in the river El Dorado are now almost completed (90%). Our aim was to redirect over a 4 km distance the course of the river and to clean the channel (digging more deeply and making it wider) in order to allow the river flow and to avoid water entering in the farm.

We got also permission to build a kind of external protection wall along the river so that in the event of a flood, the farm will not be affected. You can see some pictures below of the soil movements performed. In the highest parts, the protection wall reaches 5 meters in height.

Cattle operation and pastures: We have around 2,400 heads at the farm. Like our farm in Corrientes, dryness which affects the whole region is impacting the animals at various levels (well-being, production, diet, fertility, etc) as well as pastures available. Some heifer calves, weakened by the situation, need already to be supplied with corn and pellets as pastures are not dense enough to address their needs especially in terms of protein).Grassing area has reducing given the lack of water and the flood situation we faced earlier did allow us to sow pasture on cleaned fields (only wild vegetation has grow).

Fire: In the evening of October 15, after a hot (37°C) and windy day, a fire has started in the natural forest reserve on the outside edge of the farm (along the river). Fortunately, the gauchos could detect it on time and stopped it before entering in the productive areas of the farm (ie cattle area). Only some external fences where affected, and we have repaired them by using some wood of the natural forest reserve.

Since the beginning of the year, Fires in Argentina have raged around 7,700 km² (it’s more than a quarter of the entire country of Belgium).

PARAGUAY – Drought depletes Paraguay River (October 2020).

As mentioned in our previous posts, dryness is causing concerns in Paraguay and not only for rice producer like us. For now, the Paraguay River has reached its lowest level in half a century after months of extreme drought in the region, exposing the vulnerability of landlocked Paraguay’s economy. Around 85% of Paraguay’s foreign trade is conducted via the river, which has been depleted because of a lack of rainfall in the Pantanal area of Mato Grosso state in Brazil.

The fall in the water level has slowed down cargo vessel traffic on the Paraguay River, causing significant cost overruns for the transport of fuel, fertilizer, food and other imported goods. The crisis has also exposed the precariousness of Paraguay’s access to drinking water. Losses in Paraguay’s river transport sector have already reached $250 million. The navigation situation is critical and getting worse day after day as the river is going down at a rate of 3 to 4 cm per day. In a week, no boat will be able to reach Asunción…You can see the situation of the Paraguay River near to Asunción as of October 8.

As our farm is situated along the river Tebicuary (a tributary to the Paraná River), the situation is even worse in terms of water availability, and our business is highly depended on water (water pumped from the river should be kept standing in the rice field throughout the growth period). Water in the river has now reached such a low level that authority decided on October 8 to prohibit water pumping from the river (Official Notice).

The situation is becoming worrying for all rice producers. As you can see, water is almost no more able to reach the entrance of our main pumping station next the river. In our case, we already started to irrigate our 1st block sowed by using our water reserve from our artificial lake. Soon we will have completed the sowing of our 2nd block (so, around 1,000 has in aggregate) which will need to be irrigate during 90 days. However, no more water will be available in our reservoir and we will face a complex situation to maintain our production growing and in good shape. We will also have to evaluate if we will run the risk to sow further (3rd block of around 550 has) as we have already water shortage for the existing fields sowed.

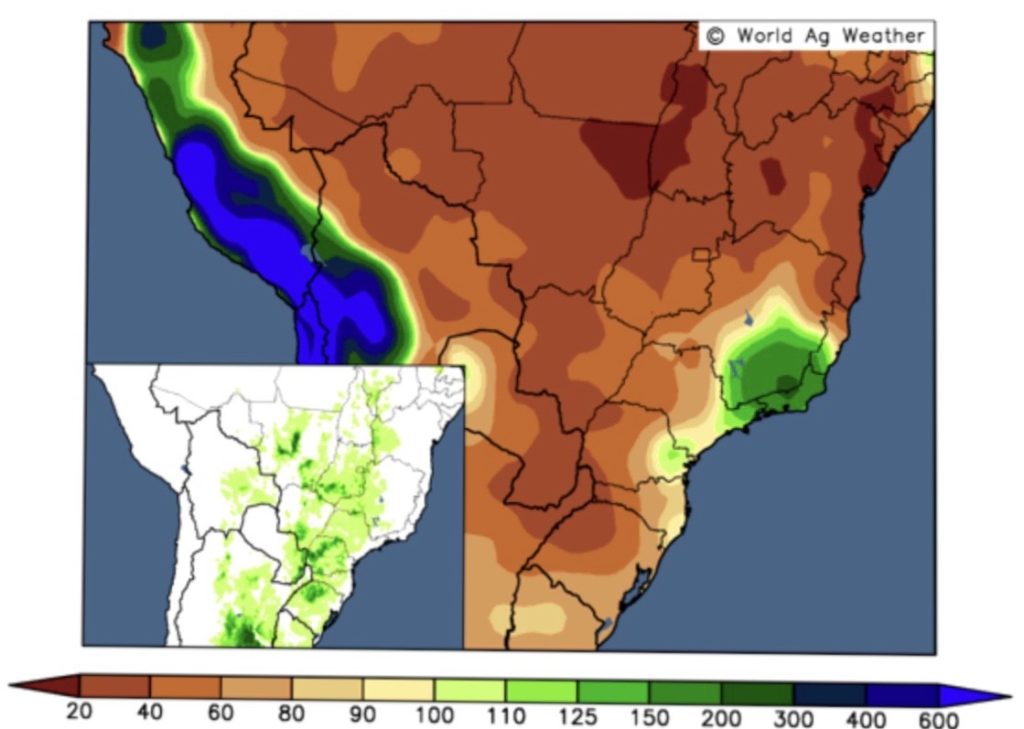

15-Day Forecast Precipitation (% of normal) – Beginning October 9.

Some minor rains are forecasted between October 14 and 15, which will helps to low down evaporation and naturally irrigate the fields for 1 or 2 days. According to the latest forecasts, 30 to 40 mm of cumulated rains should be registered in the coming 15 days. To be continued…

ARGENTINA – Debt restructuring talks with IMF (October 2020).

Set against a backdrop of swelling tension in exchange markets and fast growing poverty, the Argentine government needs to reach asap an agreement with the IMF to refinance its $44-billion credit line.

Argentina reached already in August a deal with foreign creditors to restructure $66 billion in debt after months of negotiations, and needs now to agree with the IMF on new terms on the repayment of a $44 billion loan agreed in 2018. On his side, the IMF sounds a warning over rising global debt levels and proposed reforms to the debt-restructuring process for countries that struggle to meet their obligations. In this frame, the IMF will carry out a mission on Argentina’s debt restructuring to reach an agreement over a new credit programme. Government officials say they simply want to refinance the $44 billion and that they are not seeking for additional funding.

The Central Bank’s monetary policy and currency controls will be a focal point in the government’s negotiations with the IMF for a new financing programme. To this aim, the Central Bank announced it will end a policy of “uniform devaluation” and allow greater volatility. During the 1st week of October, Argentina announced also a slew of new measures such as cutting taxes on certain crop exports temporarily as the Central Bank was losing reserves at a faster pace in recent days, in part stemming from savers withdrawing dollar deposits. Individual demand for dollars intensified after the government tightened capital controls September 15, and the dollar reached 141 per peso on the black market. Those measures do not seem to cope for now with the larger issues Argentina is dogging.

PARAGUAY – Dryness is causing concerns at Salitre Cue farm (October 2020).

Weather: The situation has not changed and we are worried about the water shortage we are already suffering from. No rain occurred since we have started sowing on August 27 and contrary to last year, we did not record the usual rains in July/August.

Currently, the low water level of the river Tebicuary (below 2 meters) doesn’t allow us to pump to irrigate the fields and we have to use already our water reserve of our artificial lake. We can mitigate some shortage for a given time but not for the entire irrigation cycle of the full area. We believe our biggest challenge this year will be to manage water availability so as all producers.

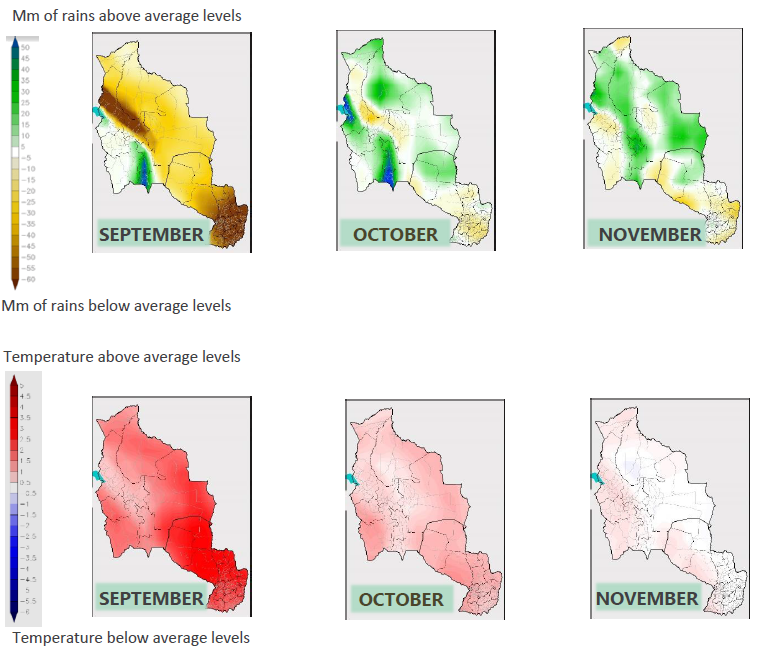

Most weather models are now pointing toward the development of La Nina phenomenon by October and persisting into maybe early 2021. This is bad news for farmers in South America because it would coincide with planting and crop development. La Nina is generally associated with dryer than normal weather in Argentina, Paraguay and southern Brazil.

Sowing: We have completed the sowing of block G (538 ha) and we have started irrigation of the field by using water of our reservoir. On October 1st, we have restarted with the sowing of our 2nd block of 427 ha. Once this 2nd block will be completed, we will evaluate the situation because if no rain occurred, rice development will be affected and it will be highly risky to sow another block (low yield and quality).

Paddy rice is strongly influenced by water supply and water should be kept standing in the field throughout the growth period. Continuous flooding helps ensure sufficient water (elimination of moisture stress and favourable micro-climate to crop production) with greater availability of nutrients such as phosphorus, iron and manganese and control weeds.

Market: Weather uncertainties combined with covid-19 fears should not reduce rice prices anytime soon. The next harvest will come after February next year, and until then the only solution would be to import the product. However, the current scenario is not a parameter for the future, since after the end of the pandemic the demand for rice may change.

ARGENTINA – New tax on USD purchase (September 2020).

The Central Bank has tightened conditions for the purchase of foreign currency, to prevent hoarding, preserve reserves and discourage demand for US dollars.

On Tuesday 15, the president of the Central Bank of Argentina (BCRA) announced a host of new measures , including a 35% tax on dollar purchases by retail savers, which will apply on top of the previous 30% so-called ‘solidarity tax.’ The extra levy will also affect credit card purchases in dollars. The monthly cap amount of USD 200 per citizen to buy foreign currencies, put in place by Macri’s administration, remains still in place.

As mentioned in the Article from La Nacion dated 15/09/20, if you spend USD 1,000 with your credit card, you will not be able to buy the monthly USD quota during 5 months. Should you have a TV or music subscription, this amount will be decreased from your cap amount (assuming a USD 20/month for a subscription, you will be able to purchase after all taxation USD 130).

This measure seeks to reduce the gap between the official exchange rate and the black market, which has soared to more than 70%. Today, the black market is at ARS 133 per USD and it raises the question of which rate to expect in near future…Argentines have been buying dollars at a record pace as the peso loses value almost every day, pushed by some anti-business government decisions, an economy in free fall due to the pandemic and lack of saving options.