PARAGUAY – End of harvest and rice delivery Status (April 2020).

Harvest status: Harvest is now completed and the final plots where harvested on April 5. Drying process of the production is also completed; it’s the most critical operation after harvesting a rice crop. Drying reduces grain moisture content to a safe level for storage. When rice is harvested, it will contain up to 25% moisture. High moisture level during storage can lead to grain discoloration, encourage development of molds, and increase the likelihood of attack from pests. Therefore, any delays in drying reduce grain quality and result in losses.

Based on preliminary results, around 12,200 dry tons of paddy rice have been produced for this campaign (meaning a dry average yield of 8t/has) with an average index of quality above 56%. We are pleased with those preliminary results given the dry weather conditions registered (hot and dry with very few small irregular rains). We had to face several restrictions periods of water pumping (either whole or partial) from the river imposed by the authorities. Some rice producers downstream had even to abandon part of their production due to dryness and lack of water to irrigate their fields.

Thanks to our artificial lack of 480 has and an efficient management of water, we could mitigate effects on the production.

Market situation: in response to growing concerns over the spread of COVID-19, Paraguayan authorities have announced the extension of the current home isolation order until April 19. All international borders are now closed until further notice. Only Cargo shipping will be permitted to cross the borders.

However, below normal rains in the Parana-Paraguay water basin is hampering grain transport through waterways in Argentina as the water level of the river has dropped significantly. The water level of Parana river at Puerto Rosario is barely one meter and the last time it was below one meter in this region was on January 10, 1989, according to a report from BCR (Bolsa de Comercio de Rosario).Grain carrying ships need to reduce the loading according to the level of water. (cf. Article from La Nacion dated 15/04/20).

This comes at a time of the peak harvest of corn and soybeans in Argentina. Moreover, truck movements in the country already face some issues due to restriction imposed to control the spread of COVID-19.This is not only impacting the delivery chain, but mills had also to postpone their purchase of material and producers had to stop their deliveries (sales) and stored their production (silos, in house or by 3rd party, silo bags).

On our side, we are currently completing the delivery of contracts concluded before quarantine was declared there. Our remaining production is stored in our silos of 9,000 tons capacity. It’s a significant competitive advantage to have its own facilities to avoid growing storage costs or lost in sill bags (manipulation lost and can not store for a long time Vs in silos).

PARAGUAY – Harvest is about to end while deliveries started (March 2020).

Harvest status: Despite the current challenging sanitary environment, over 1,200 has have been harvested, dried and stored in our silos. Preliminary dry average yield achieved is above 8 t/has. We are in the process to harvest the last plots (around 400 has) but the crop was still too humid to start (humidity level of 28 to 30% while 26% is targeted). Harvest should be finalized by end of March – beginning of April.

Market situation:

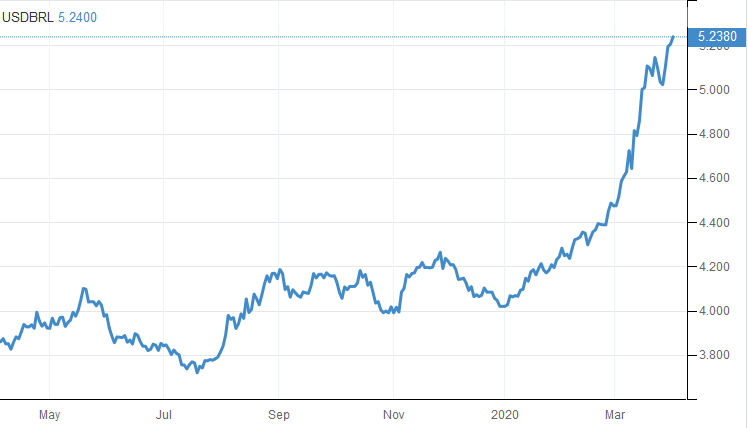

The Brazilian real continued to depreciate to trade above 5.1 against the USD (see chart USD to BRL below). The real has been falling since the beginning of the year to trade now at its historical lowest level due to persistent worries regarding the country’s economic growth, the impact of the coronavirus pandemic and despite central bank efforts to support the currency. The Brazilian situation has a significant impact on the Paraguayan rice market as 90% of its production is exported to Brazil. Early March, we sold 1,500 tons of paddy rice to local mills (deliveries are in progress) for USD 20 per ton more than actual price.

Water level of all rivers, including the Paraguay River (mainstream for grain shipping), are at their minimal level which generate logistic difficulties.

Social isolation is impacting custom services and trucks traffic, so that the delivery of Paraguayan products to Brazil is slower than in normal situation.

For now, we prefer to store our paddy rice in our silos waiting for more stability.

ARGENTINA-PARAGUAY-URUGUAY – Covid-19 Pandemic (March 2020).

Over 10,000 cases of contamination have now been declared in Latam countries (Argentina has registered around 1,000 cases while Paraguay 100, but cases are significantly increasing day by day).

Like other countries in the world, the countries in which we operate, have temporally closed their borders in response to growing concerns over the spread of COVID-19. Borders have been closed to all non nationals or non-resident foreign nationals. Flights have been suspended, all inbound and outbound commercial as well as private flights. However, no restrictions have been applied to cargo service aircraft and aircraft that provide medical, emergency services, and foreign nationals who are repatriating. People entering from abroad will be subject to self-quarantine for 14 days. Authorities have also introduced general preventative isolation. During this time, people must remain in their place of residence, and may only leave for essential travel such as stocking up on food, medicines, and cleaning supplies.All those measures are in place and may be extended and reinforced as needed by local authorities.

For us, farming activities are not subject to restrictions for now and we continue to operate normally our cattle farms and forestry in Argentina as well as our rice production in Paraguay. We are part of the food chain. As for our central administration performed in Buenos Aires, we have closed our office on March 17 and all staff is now working from home. Daily tasks are performed normally.

Our priority is to provide secured work conditions to all our staff and to ensure business continuity as much as possible. The situation is involving daily, and we are trying to be pragmatic as much as possible

ARGENTINA – Update on Tata Cua forest activities (March 2020).

We have just sold 615 m3 of wood from Tata Cua forest (pines and eucalyptus) to a wood processor. The cuts will start on March 20 and be spread over 4 months. The panted surface with trees is amounting to 580 has of which 48 has are going to be cut.

ARGENTINA – More taxes on farmers to fix budget woes (February 2020).

While discussions on Argentina’s debt with IMF and bond holders (creditors) are ongoing, Argentina is having difficulty raising cash with which to pay the lenders. Now, the government is set to deliver another duty blow as it taps the nation’s growing agriculture industry to try and deal with budget woes. Many of Argentina’s farmers are still reeling from a tax increase on crop exports that hit them late last year.

President Alberto Fernández plans to raise export levies on soybeans as it seeks to bridge its fiscal deficit. The taxes will rise to 33% from the current rate of 30% (a 3% points increase is expected to generate USD 500 million incomes more for the state). Although the timing of the announcement is still unclear, this move would mark the second increase in agricultural taxes since President Fernández took over just over two months ago. The policy reverses the bias favourable to the farmers of Macri’s administration. Likely other commodities like corn or wheat may see their existing exports duties increased in the coming months. When Mrs Kirchner ended presidency in 2015, soy exports were subject to duties of up to 35%, with 20% corn and 23% on wheat. To be continued …