PARAGUAY – Update on Salitre Cue farm activities (December 2021).

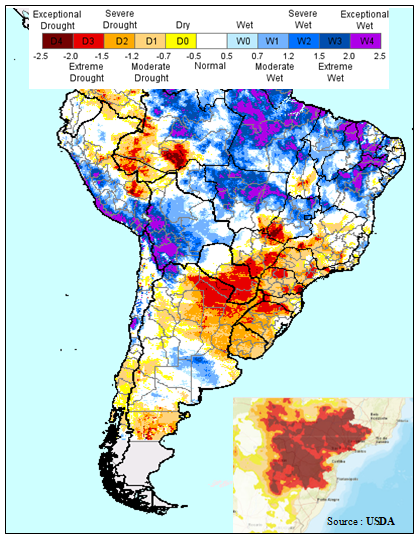

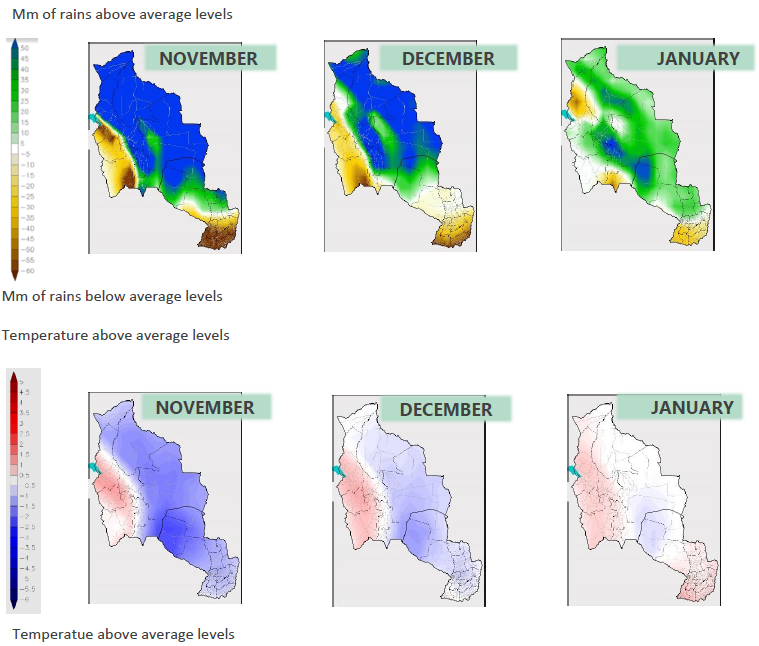

Weather/Situation: La Niña conditions are back and may lasting until spring 2022. No rain has been recorded yet this month and is planned for now. You can see on the below map dated 05/12/21, the drought situation faced. Our region is classified in “extreme drought” situation so as most part of the La Plata Basin.

The river Tebicuary, a tributary to the Paraná River, is at a low level as you can see on the picture, and it’s currently impossible to pump water directly from there.

Rice: The 560 ha sowed with rice are currently under irrigation and we are forced to use our water reserve from our artificial lake to get those fields irrigated. Normally, we should have enough water in our artifial lake to irrigate 60 days more all the plots. It’s key to have continuous flooding of water as it provides the best growth environment for rice.

Soybean: 1,100 ha have been sowed as planned successfully. The crop is developing very well so far as you can see. Soybean diversification helps us to mitigate our previous exposition to the sole cultivation of rice. Outlooks for this crop are very positive as in opposite to rice whose ultimate sole market is human consumption.

Corn: We were trying to close some third party leasing contract to develop this crop. Unfortunately, we could not close any lease agreement as the operator interested in our surface could not provided sufficient guarantee to operate properly the lease surface neither to have sufficient inputs available to show the wishes surface. As this option was explored for 1-year, we decided not to move forward. And preserve the quality of our land.

ARGENTINA – Update on Curupi Pora farm activities (December 2021)

Situation/weather: We continue to enjoy some little rains which help for the regrowth of our permanent pastures as well as for the development of the 120 ha recently sowed with setaria. This setaria will be a permanent pasture for grazing and for cut fodder.

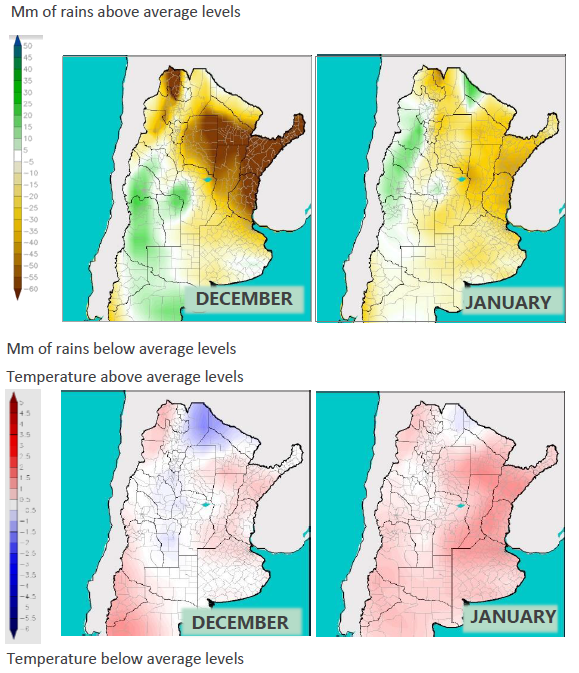

For now, the farm is in great shape. However, La Niña is set to wreak havoc during Argentina’s upcoming summer, according to the latest report of the Buenos Aires Grain Exchange; only little rain will fall in January and February across most of the country.

Cattle operation: Our cattle herd (over 6,500 heads currently) is performing very well. We are currently working on the spring service, where between 2,800 and 3,000 cows and heifers are in service. In terms of beef production, 195 tons were produced by end of October (31% of the annual objectives).

For now, no cattle sales are planned. It’s important to mention that the Argentine government has extended beef export restrictions until the end of December. Restrictions will remain in place for 7 cuts of beef to ensure domestic supply.

However, Argentina has lifted bans on exporting beef to China and under the new guidelines, cows which “no longer have reproductive capacity and that are mostly not consumed in the domestic market” can be sold to China. As a result, Argentine beef prices rose by 25% in November. It’s worth to mention that Argentina so as Paraguay or Uruguay are taking benefit here from the Chinese ban on Brazil’s beef. Beef exports from Brazil to China were suspended after 2 cases of “mad cow” were reported, one in Minas Gerais and the other in Matto Grosso.

Argentina’s government is preparing a farm sector roadmap for the next 2 years and hopes to ease conflicts with the sector over caps on meat exports and grains. President Fernández’s government sorely needs farm export dollars to replenish depleted currency reserves and to pay off debt amid talks to delay $45 billion it owes the IMF. Nevertheless, market interventions are not likely to generate confidence and investment in a country that desperately need it.

PARAGUAY – Update on Salitre Cue farm activities (November 2021).

Weather/Situation: Although the weather forecast remains very worrying for the season (see weather map below), we are for the moment very lucky because we have recently recorded good abundant rains as you can see.

Those rains help us a lot as the level of the river recovered and we can again pump water directly from there to irrigate rice without using our water reserve in our artificial lake (back up in case of water stress period). We hope that these conditions will be maintained during the coming months (blooming stage when grains are filled).

Soybean: Over 800 ha have been sowed so far and are nicely developing as you can see. We are maintaining our forecast to sow 1,100 ha.

Rice: We have completed the sowing of 560 ha. The 1st plots sowed are developing well so far. We are at 1st stage and will start beginning of December with 2nd stage when the plants are large enough to withstand shallow flooding. The full irrigation cycle of the crops takes 90 days and it’s important to mention that continuous flooding of water provides the best growth environment for rice.

We are not going to sow rice in block G (450 ha) given weather uncertainties and the extreme low level in the Paraguay River has heavily delayed the supply in all inputs. As a consequence, it is s to risky to start sowing rice in this block. We will stay with 560 ha of rice for this season.

Corn: As previously mentioned and rather than increasing the potential soybean area by reallocating rice surface to soybean, we have enter in negotiation with a third party for the lease of our available surface (up to 1,000 ha) to cultivate corn. This will be a 1-year scenario; weather situation implies us to be pragmatic. The outlook for corn is attractive and it will allow us to diversify our risk/mix.

ARGENTINA – Update on Curupi Pora farm activities (November 2021).

Situation/weather: The farm is currently in very good shape as we have registered several good rains at the farm which allows the densification of the pastures.

You can see the dense pastures at our lagoon were the cattle have access to refresh. This is very good for our cattle activities. However, weather forecasts announce a drought period for January to March 2022 (La Nina) and to this aim, we bought already pellets for supplementation on the market as grassing area will have reduced after this period.

Cattle operation: Our cattle herd (over 5,200 heads currently) is performing very well and has a great uniformity as you can see. Below, you can see claves.

Here, you have some bulls which have been sold recently and which are going to be delivery to our client.

We have started spring service where between 2,800 and 3,000 cows and heifers are in service. Insemination of the animals already took place. In our farm in Salta (San Bartolo), the service started later given the climate and farm specificities (January). There, around 1,300 mothers will be in service.

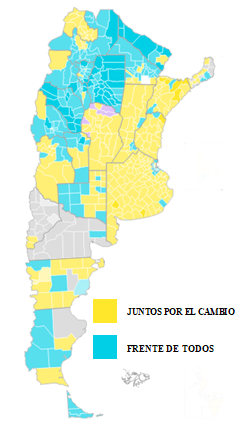

Argentina – Government loses majority in Congress after midterm elections (November 2021).

Already in the minority in the lower house Chamber of Deputies, Fernández’s Frente de Todos coalition looks set to drop from 41 to 35 seats in the 72-member Senate, based on projections with more than 98% of votes counted in the midterm elections held on 14/11/21.

According to a breakdown published by La Nación newspaper, the opposition Juntos por el Cambio coalition took 41.97% of the national vote (all votes cast), with the ruling Peronist coalition on 33.57%. The opposition, which will now gain ground in both chambers of Congress, scored key victories in Buenos Aires City and the provinces of Buenos Aires, Córdoba, Mendoza and Santa Fe, regions that carry a lot of electoral weight. Juntos por el Cambio also emerged victorious in the provinces of Jujuy, La Pampa, Chubut, Corrientes, Entre Ríos, Misiones, San Luis and Santa Cruz.

Mr Fernández will now likely be forced to make concessions to the opposition during the last two years of his mandate in order to pass laws or make key appointments. Even if the more investor-friendly opposition gained power, the country will face economic turbulences in the coming months. Among others, Argentina is in a tricky renegotiation with the I.M.F. over the repayment of a US 44 billion debt. If no new repayment schedule is found, Argentina will have to repay US19 billion in 2022 and as much again in 2023. Let’s see some light despite all the darkness… Mrs Kirchner will no longer have a bloc in the Senate that guarantees she can pull the strings at her own pace.