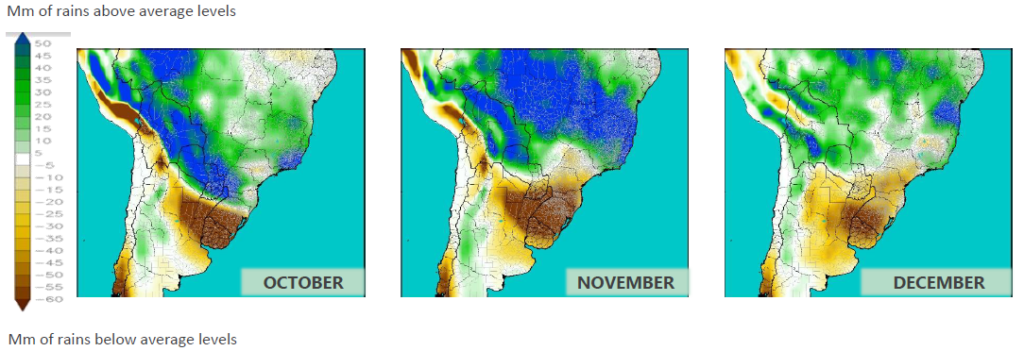

Situation/weather: We have now entered in winter season but with unusually mild temperatures for the period. It’s very strange or unusual to see the farm so “green” during this time of the year. We could register some good rains in May which help the recovery of pastures after the drought period faced earlier this year again. The farm is currently in good shape and we are entering winter in very good conditions.

Cattle operation: We have currently above 6,300 heads at the farm. We are in the peak season for cattle sales. This year, we have planned to sale over 1,600 animals.

Below, you can see some pregnant cows (spring service of 2022).

Here, some heifers 2 years old which will enter into spring service in October 2023.

Below, you have some cows with their baby calves which are going to be weaned in July. You will also see some cows that have just finished fall service (April/May 2023).