Situation/weather: Drought has prevailed in northern Argentina during most of the growing season that began in late September and October. Dryness reached serious proportions a number of times, but most recently during January and February. Corrientes province, which is mainly focused on cattle and rice operations as well as forestry, was not spared from La Niña phenomenon.

As of 03/16/2018, cumulative rainfall for the cycle was 796 mm or -29% compared with the historical average for the same period. The good news is that we are now again able to access the limit of the farm bordering with Santa Lucia river.

Cattle operation: our cattle herd (5,911 heads currently) is overall in good conditions even if some categories, more sensitive to high temperature, are a bit lighter than they should be. An abundant supply in water to the herd is key here, completed by other actions (high quality silage, more health controls, cattle handling only early in the morning during heat waves, etc). Management is key during those phases.

Pasture-fed cattle: Pasture planted last October showed good resilience to heat waves and water shortfalls. We are also in the process to start aerial sowing of 144 hectares with OAT. OAT not only has a high protein content to feed cattle but is also cleaning the soil and improving its structure. This sowing will be completed with Ray grass pasture over 260 hectares as it supports high loads of animals per hectare, making it a species

particularly suitable for grazing.

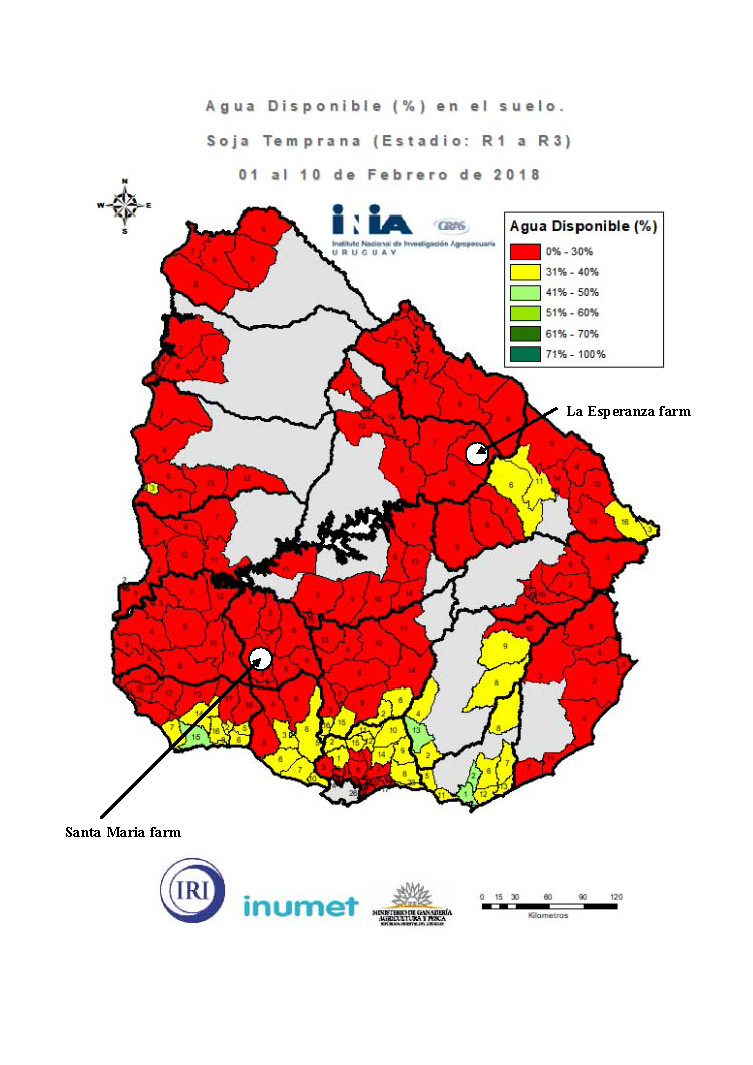

Corn: 270 ha have been sowed in February for self-consumption after having been delayed due to lack of humidity. For now, the crop is in blooming stage but we already anticipate to get lower yield than usually (4.75 t/ha) given delay faced in sowing and dryness.