The Central Bank has tightened conditions for the purchase of foreign currency, to prevent hoarding, preserve reserves and discourage demand for US dollars.

On Tuesday 15, the president of the Central Bank of Argentina (BCRA) announced a host of new measures , including a 35% tax on dollar purchases by retail savers, which will apply on top of the previous 30% so-called ‘solidarity tax.’ The extra levy will also affect credit card purchases in dollars. The monthly cap amount of USD 200 per citizen to buy foreign currencies, put in place by Macri’s administration, remains still in place.

As mentioned in the Article from La Nacion dated 15/09/20, if you spend USD 1,000 with your credit card, you will not be able to buy the monthly USD quota during 5 months. Should you have a TV or music subscription, this amount will be decreased from your cap amount (assuming a USD 20/month for a subscription, you will be able to purchase after all taxation USD 130).

This measure seeks to reduce the gap between the official exchange rate and the black market, which has soared to more than 70%. Today, the black market is at ARS 133 per USD and it raises the question of which rate to expect in near future…Argentines have been buying dollars at a record pace as the peso loses value almost every day, pushed by some anti-business government decisions, an economy in free fall due to the pandemic and lack of saving options.

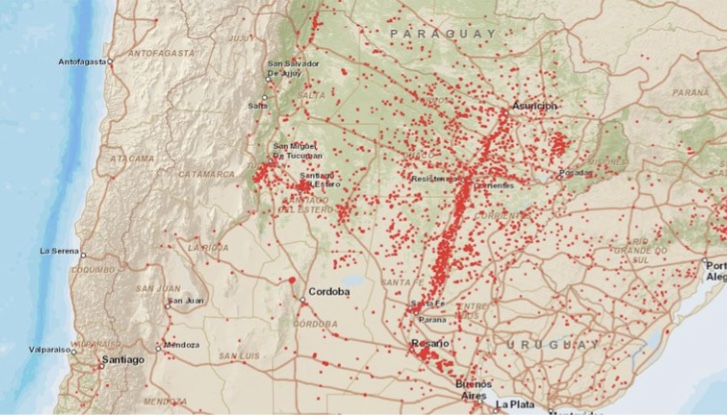

source: NASA FIRMS

source: NASA FIRMS