The evolution of the sector is interesting to monitor for cattle producers like us as it foreshadows the price and volume of some consumables for livestock.

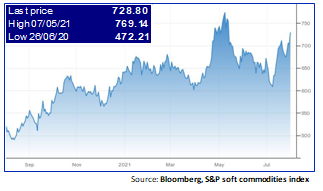

International 1-year wheat prices (USD/Bu):

Wheat: Prices have risen but have not yet reached the record levels of 2011 and 2012. Recent increase due to the drought effect in the USA.

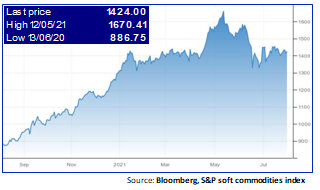

International 1-year corn prices (USD/Bu):

Corn: +72% since June 2020. Improvements in growing conditions in Europe and the USA, and increased yields in Argentina and Brazil leading to a downward correction in prices.

International 1-year soybean prices (USD/Bu):

Soybean: +70% since June 2020. The new surge in prices is not like in 2012 solely linked to the boom of agro fuels.

What are the drivers?

A dynamic demand led by China: China imported a record 32 million tons of grain and 100 million tons of soybeans in 2020, and continues to import corn at an unprecedented rate. With the pandemic, importing countries have increased their strategic reserves to avoid supply disruptions.

Tensions linked to export restrictions: export taxes and quotas instituted by producing countries to contain domestic prices (Russia, Ukraine, Argentina) are also increasing the pressure on prices.

Concerns about the level of world stocks: -10% for corn and -22% for soybeans in forecasted for 2020/21.

The drought which has affected Europe, USA, Brazil and Argentina (La Niña).

Weakening emerging currencies against the US dollar has favoured exports.

…World meat prices are only starting to follow crops prices increase. This delay in revaluation is explained by the importance of food costs, which must necessarily be reflected in prices.

Source: Bloomberg

Source: Bloomberg