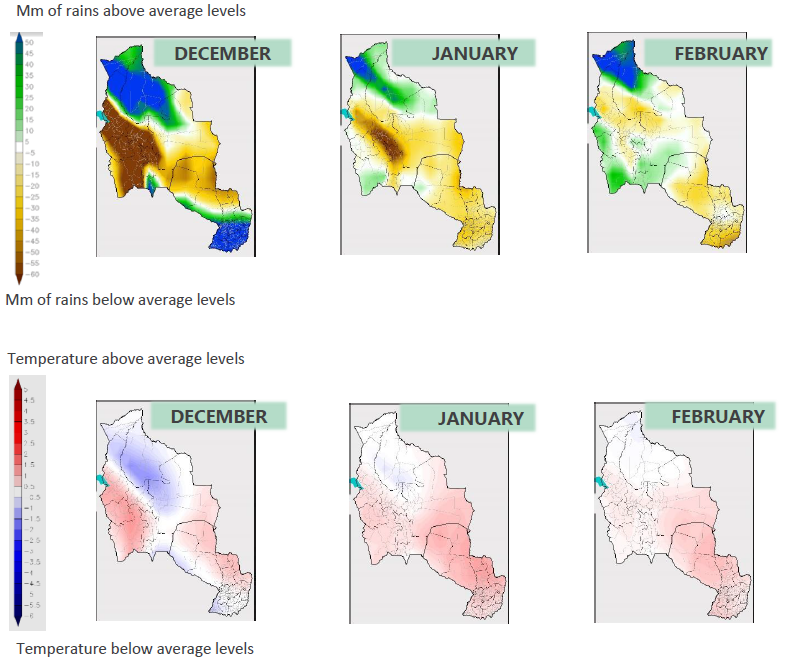

Weather: The situation remains unchanged as a large part of South America is in the grip of a serious drought. Over the last month, we registered 77 mm of disparate rains whereas it’s generally raining 246 mm on average. Given the ambient temperatures which exceed 40°c during the day, the rains did not even manage to permanently moisten the soil (immediate vaporization).

The forecast for the next 3 months indicates that water deficits will continue to shrink considerably. Severe deficits are forecast in Brazil from Mato Grosso do Sul through São Paulo State, in Paraguay and in the northern region of Argentina.

Sowing and irrigation: Only 1,000 has have been sowed and we are not going to sow any incremental surface given the situation. Among the surface sowed, 500 has of plants are going to be abandoned given the lack of water available. At the stage, rainfalls registered are only boosting weeds for the 2nd stage sowing.

We have allocated the raining water available from our artificial lake to the 1st block sowing (Block G) as the crops was in a more advanced stage of development. However, the blooming stage of the crop is also comprised due to water stress.

Our reservoir is fully empty so as the river where authorities prohibited any water pumping. Our operating team is expecting now yields in a range of 1t/has to 3t/has for the 1st block sowed – meaning 1,500 t of paddy in the best scenario. All rice producers along the river Tebicuary are in the same situation; some are even worse as they sow they entire forecasted surface and will have to abandon it as they did not have water reserve’s like us to mitigate the shortage in water registered over the last months.

We are taking advantage of the very low river level to deepen the entrance to the channel so as more water can in future access the pumps.

Market: Brazilian and Paraguayan mills are still looking actively for product, driving paddy prices to peak level ($280/$290 per ton). However, production will only start to be available by end of January for some producers, except for those who stored their previous harvest. Paddy prices are expected to remain at peak level this year but we cannot predict if we have entered in a new cycle of commodities or if the current situation is related to COvid-19 and a ought climate . Last October, South America experienced its 2nd most intense drought in almost 2 decades.