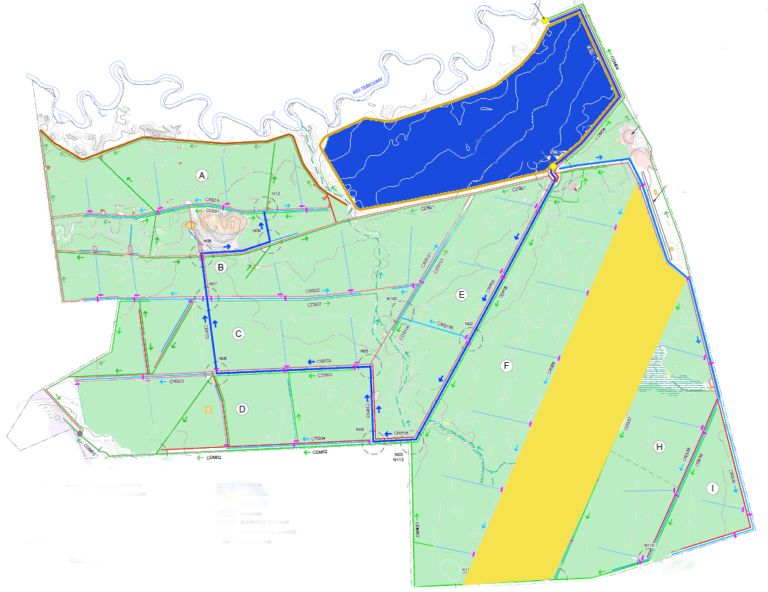

Sowing: On August 27, we began with the rice sowing period and started to sow block G (540 ha – in yellow). Our objective for the cycle is to sow our so called “base” surface of 1,600 ha and the production is dedicated 100% to IRGA 424 cultivation.

Our strategy is to sow in 3 stages the full surface allocated to paddy rice production. This way, we can have a harvest in stage and reduce our operating risks (weather issues and irrigation restrictions) while we will have a better control of the plots as they are not going to be all in the same stage at the same moment.

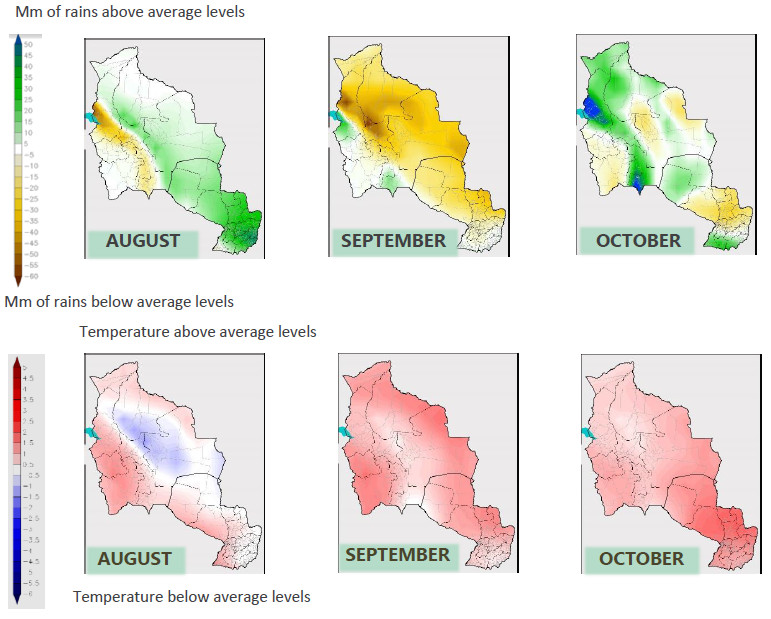

Weather: Our biggest concern is the forecast of “La Niña” climatic phenomenon. Already, we registered less rains than usual during its peak period (July/August) and the forecast are not encouraging. We need water to irrigate the field after sowing occurred. We can mitigate some shortage thanks to our reservoir but not for the entire irrigation cycle of the full seeded area. For this reason, we are also sowing in stages in order to have not all the surface at the same time under irrigation. But likely, our biggest challenge this year will be to manage water availability so as all producers.

Market: Locally paddy rice price rise recently in Brazil (+17% month on month in real). The weakness of the real, which reached a record low at 5.89 per dollar on May 14, has sharply increased the competitiveness of Brazilian paddy exports. Additionally, extremely tight paddy stocks in the US South have meant that Brazilian exporters have faced little competition selling to Central America and Venezuela this year. During the first half year, exports went up by 79% year on year. Meanwhile, the weak real has hindered imports, which went down by 12% year on year during that period. So Brazilian mills are now buying from neighbouring countries (Paraguay, Argentina and Uruguay) to supply the domestic market and protect their market share. This drives up paddy prices.

Market: Locally paddy rice price rise recently in Brazil (+17% month on month in real). The weakness of the real, which reached a record low at 5.89 per dollar on May 14, has sharply increased the competitiveness of Brazilian paddy exports. Additionally, extremely tight paddy stocks in the US South have meant that Brazilian exporters have faced little competition selling to Central America and Venezuela this year. During the first half year, exports went up by 79% year on year. Meanwhile, the weak real has hindered imports, which went down by 12% year on year during that period. So Brazilian mills are now buying from neighbouring countries (Paraguay, Argentina and Uruguay) to supply the domestic market and protect their market share. This drives up paddy prices.

Brazilian average paddy prices 2019/2020 (USD/t – Rio Grande do Sul)

Source: ESALQ

Source: ESALQ

Furthermore, international rice prices are also following currently this trend. The price of rice which is a staple food in Asia, has rencently hit 7-year highs due to the Covid-19 outbreak as importers rush to stockpile the grain while exporters curb shipments. According to Reuters, rice prices are now at their highest since late April 2013. The rise in prices is due to expectations of higher demand for Thai rice after fellow top exporters India and Vietnam both facing export disruptions due to Covid-19. Labour shortages, logistical disruptions and the importance of rice as a staple food have leads to export curbs.Earlier this year, North America, Europe and China faced also labour shortages and supply line disruptions during their spring planting due to the pandemic. All those factors explain the recent boom in rice prices. We hope that we are going to benefit from those prices when our harvest will be completed in March/April 2021.